Why read this article?

For Airbnb hosts and property managers who use property management software and host Airbnb listings mostly outside of the US, Airbnb is moving away from the split-fee pricing model and is moving towards what they call a “simplified fee structure”. For hosts within the US, this may be a glimpse of what may come.

Senior Partner Manager at Airbnb, Simona Zudyte, announced today that on December 7th, 2020, all hosts who use property management software and have greater than 50% of their listings outside of US, Mexico, Canada and a few other regions; Airbnb will begin to deduct a flat 15% host service fee from each payout to hosts rather than sharing the fee with the guest.

(If you haven’t already, be sure to check our comprehensive guide to Airbnb Accounting & Bookkeeping)

Who this affects

“Software connected hosts only, except those who have at least 50% of their listings in US, Mexico, Canada, Taiwan, Argentina, Uruguay and the Bahamas.”

Simona Zudyte

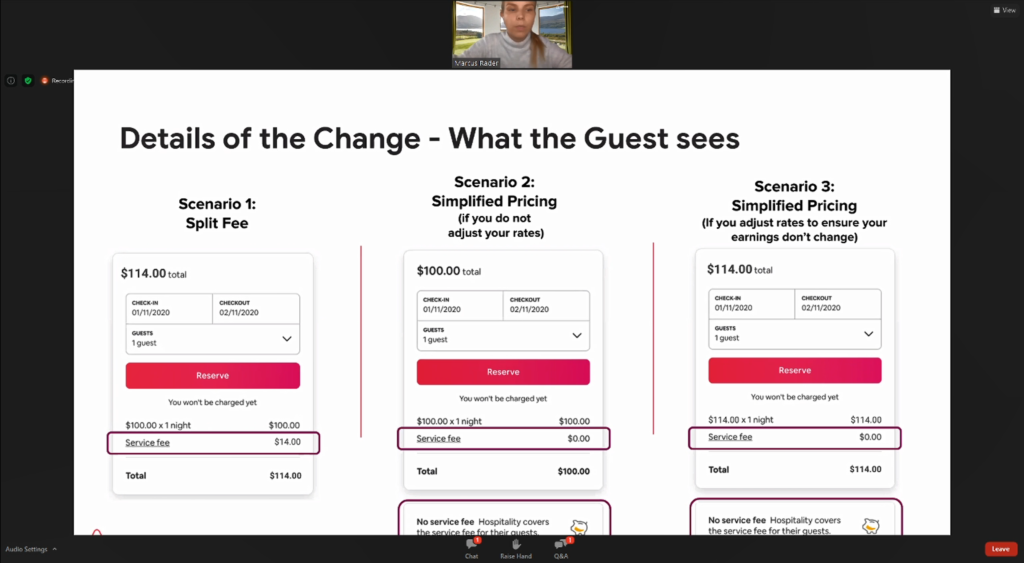

Today, hosts can choose between two fee structures: split-fee pricing with the fee shared between hosts (3%) and the guests (0-20% which is added on top of host rates), and Simplified Pricing with the entire fee covered by the host (15%).

After December 7th, 2020, split-fee pricing will no longer be available and the host fee will be set at 15%.

Benefits of Host-Only Fees

According to Simona, those hosts who have already adopted this fee structure have received a 17% increase in bookings on average, stating that listings with this fee structure are “more appealing to guests.”

Furthermore, if you’re managing the same listings on other channels, this new fee structure also makes it easier to manage consistent pricing across differing websites. It’s also easier to communicate transparently any price changes when there are reservation adjustments or refunds.

You’ll also know exactly what guests see when they pay for their reservation.

What does this mean for VAT

To avoid being charged a VAT, hosts will have to ensure they’ve entered their VAT registration number in their Airbnb account. To do so, log into Airbnb and go to your host account settings. Under taxes, enter the VAT registration number.

Not all hosts have the option to select the host-only fee structure

Hosts in the United States or hosts who don’t use property management software may not have the ability to select this option.

Some hosts may want to include all Airbnb service fees in their price, where no service fee will be added to the nightly price on the guest’s side and a 15% host service fee is deducted before their payout.

However, some hosts cannot add the host-only fee to their Airbnb listing. Which means, as usual, they will pay a 3% service fee out of the price they set, but their guests will pay up to 20%, which may deter guests from their listings and provide an advantage to larger property managers who use property management software.

How to switch and adapt to the host-only fee

If you’re a host and adopt the host-only fee, your overall pricing will change and you may want to add this change back into your overall prices. Simona highly recommends to check all your prices for all of your listings to make sure you’re not undercutting yourself.

Also, if you’re a property manager who lists Airbnb properties on behalf of your clients and you switch over to this new fee structure, you’ll likely need to have a discussion with your clients about the new change. Make sure they understand the new definition of the fee, the effect it will have on the overall income and who’s going to bear the reported increase in Airbnb’s new host fees.

What this means for accounting?

If hosts choose the host-only fee structure, it becomes even more important to track host service fees for deductions since these deductions will be five times greater. Plus, Airbnb may not subtract these fees from reported host earnings (see Airbnb 1099 Filings for US Hosts for example).

Therefore, we highly recommend hosts to record their income with a well known accounting system like QuickBooks Online and use Tallybreeze (formerly Bnbtally) to perfectly track their host fees for each reservation. This way the precise deductions can be made.