Why should you read this guide?

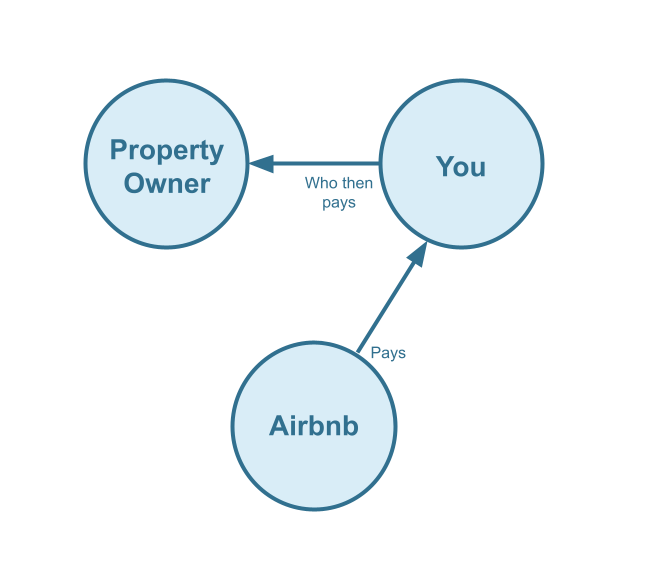

This is a guide about Airbnb property management accounting and automation for those who use QuickBooks accounting software. Airbnb property management is an increasingly lucrative industry. Additionally, for short-term rentals, many jurisdictions do not require licensing or strict trust accounting rules for managing short-term stays on behalf of owners. In this guide, we present an alternative accounting method for those in Airbnb property management who do not use a trust account. In this case, rather than using a trust account, all funds are directly collected from Airbnb and declared as income by the property management company. From there, a portion is paid out to owners as a direct cost.

Although this method of accounting may not be considered the most conventional, it is widely used for two main reasons. First, it’s vastly simpler than trust accounting as it only requires a third of the data entry and training necessary to maintain. Second, the property manager can claim a higher income, which is useful for requesting a business loan. Therefore, if there’s no trust accounting requirements in your jurisdiction, you may want to consider this straight-forward accounting method.

DISCLAIMER: If you are operating in a jurisdiction that has legal requirements for Airbnb property managers to use a trust account, the accounting method discussed in this guide is not for you. There are plenty of jurisdictions that consider property managers as custodians with a fiduciary responsibility to the property owner, which requires a more comprehensive trust accounting method.

NOTE: In this guide, we only cover income accounting, not costs. For a guide about Airbnb costs and chart of accounts to consider, check out this guide instead: Airbnb Costs and Chart of Accounts to Consider

Table of Contents

What you’ll get from this guide:

- A QuickBooks template for this method of Airbnb Property Management

- Learn how to automate Airbnb property management accounting with Tallybreeze

- Execute common transaction workflows in QuickBooks

- Generate monthly owner statements and reports for your clients

Cash Flow Diagram

Who should not read this guide?

There are other business models that may be more suitable in your particular scenario, which are covered better in the following guides:

- Trust Accounting for Airbnb Property Managers in QuickBooks

- Airbnb Co-Host Accounting in QuickBooks

- Airbnb Arbitrage Accounting in QuickBooks

- Airbnb Investment Accounting in QuickBooks

- All Airbnb templates for QuickBooks

- Airbnb Accounting & Bookkeeping: A Comprehensive Guide

Airbnb Property Management: QuickBooks Chart of Accounts for Airbnb Income

We will now describe our chart of accounts template in great detail. With this chart of accounts template, you can create a highly organized system to keep track and manage all Airbnb revenue.

Account Codes

| No. | Account | Type |

|---|---|---|

| 24000 | Rental Liability | Liability |

| 24100 | Rental Liability: Airbnb Owner Funds Payable | Liability |

| 24200 | Rental Liability: Airbnb Custom Taxes Payable | Liability |

| 42000 | Rental Revenue | Revenue |

| 42100 | Rental Revenue: Airbnb Income – Accommodation Fare | Revenue |

| 42200 | Rental Revenue: Airbnb Income – Cleaning Fee | Revenue |

| 42300 | Rental Revenue: Airbnb Income – Resolution Adjustment | Revenue |

| 42400 | Rental Revenue: Airbnb Refund – Accommodation Fare | Revenue |

| 42500 | Rental Revenue: Airbnb Refund – Cleaning Fee | Revenue |

| 42600 | Rental Revenue: Airbnb Refund – Resolution Adjustment | Revenue |

| 51000 | Rental Costs | Cost of Service |

| 51100 | Rental Costs: Airbnb Service Fee | Cost of Service |

| 51200 | Rental Costs: Airbnb Amounts Due to Owner | Cost of Service |

| 61100 | Airbnb Tax Withholdings | Expense |

NOTE: In this guide, we only cover income accounting, not costs. For a guide about Airbnb costs and chart of accounts to consider, check out this guide instead: Airbnb Costs and Chart of Accounts to Consider

Detailed Explanation of Accounts

Each account charted is precisely defined below. This accounting method is for Airbnb Property Management businesses that do not use a trust account to manage funds. Rather, the property manager’s operations account is used to collect Airbnb funds and pay out to owners. As such, you’ll notice that amounts paid to owners are considered a cost to the business. This is also balanced by an Owner Funds Payable account. Read below to learn more about any particular account.

Rental Liability

24000 – Rental Liability – This is a parent account with child accounts that account for rental liabilities.

24100 – Rental Liability: Airbnb Owner Funds Payable – This account tracks Airbnb funds payable to owners. This is for property management businesses that do not use a trust account to manage funds.

24200 – Rental Liability: Airbnb Custom Taxes Payable – This represents all Custom Taxes collected from Airbnb and payable to a tax authority.

Rental Revenue

42000 – Rental Revenue – This is a parent account with child accounts that account for rental revenue.

42100 – Rental Revenue: Airbnb Income – Accommodation Fare – This account tracks the accommodation fare portion of each Airbnb reservation. The accommodation fare is equal to the number of nights multiplied by the average nightly rate of each reservation.

42200 – Rental Revenue: Airbnb Income – Cleaning Fee – This account tracks the cleaning fee portion of each Airbnb reservation.

42300 – Rental Revenue: Airbnb Income – Resolution Adjustment – This account tracks any resolution adjustments collected from Airbnb.

42400 – Rental Revenue:Airbnb Refund – Accommodation Fare – This account tracks accommodation fare refunds executed by Airbnb..

42500 – Rental Revenue: Airbnb Refund – Cleaning Fee – This account tracks cleaning fee refunds executed by Airbnb.

42600 – Rental Revenue: Airbnb Refund – Resolution Adjustment – This account tracks resolution adjustment refunds executed by Airbnb.

Rental Costs

51000 – Rental Costs – This is a parent account with child accounts that account for rental costs.

51100 – Rental Costs: Airbnb Service Fee – This account tracks service fee costs from Airbnb for each reservation, which is subtracted from the income.

51200 – Rental Costs: Airbnb Amounts Due to Owner – This account tracks amounts paid to owners as a cost to the business. This account is for property management businesses that do not use a trust account to manage funds.

61100 – Airbnb Tax Withholdings – This account tracks any taxes withheld by Airbnb for income tax obligations. This is very rare and usually due to the Airbnb account holder lacking tax identification information. Ideally, this account should not contain any balance and is seldom (if ever) used. To avoid income tax withholdings from Airbnb, be sure to update your Airbnb account with your tax identification information and verify your account.

Accounts not included in this template

For the scope of this guide, we’re mainly focused on Airbnb revenue recognition. It is important to point out that our template does not include many general accounts. We also make reference to some accounts not included in this particular template, which we’ll list here:

- 11000 – Airbnb Payment Clearing Account – This account is created by Tallybreeze (formerly Bnbtally) but is not included in this template in particular. This account is used to apply payments to Airbnb invoices upon the day the Airbnb reservation payout is posted. Payouts can take 3-5 days (or longer) to arrive in the bank account after posted from Airbnb. Monies owed are held in this clearing account until the payouts are received in the bank. This account also helps to automate the reconciliation process in QuickBooks.

- 1XXXX – Operations Bank Account – This is your business operations bank account set up with your financial institution. It’s a cash asset account to facilitate your Airbnb property management company’s day-to-day business operations.

- 4XXXX – Billable Expenses Income – This is a general account for capturing income received for the payment of billable expenses by owners, which may include a markup.

- 7XXXX – Billable Expenses – This is a general account for tracking billable expenses for any owners.

Quick Setup Steps

Here’s how to import the above chart of accounts template. All of the accounts discussed in this article can be imported into QuickBooks automatically using Tallybreeze’s setup tools. Here’s how to access this utility…

- If you haven’t already, Sign Up to Tallybreeze. It includes free use of this template.

- Once registered, go to the Connections manager in Tallybreeze. Connect your Airbnb account, connect your QuickBooks Online account and then create a connection between the two.

- Within the Connection settings, select “Set Up QuickBooks”

- Select your business model from the drop-down list at the top and select “Import Template to QuickBooks”.

How to Automate Airbnb Property Management Accounting

Airbnb accounting can be automated using Tallybreeze (formerly Bnbtally), which allows the Airbnb Property Management company to reconcile all reservations in great detail and allocate payments to owners on-the fly. A reservation made through Airbnb is automatically retrieved and processed given the accounting rules set in the Tallybreeze software. We’ll discuss this feature further along with how it works using the chart of accounts discussed above.

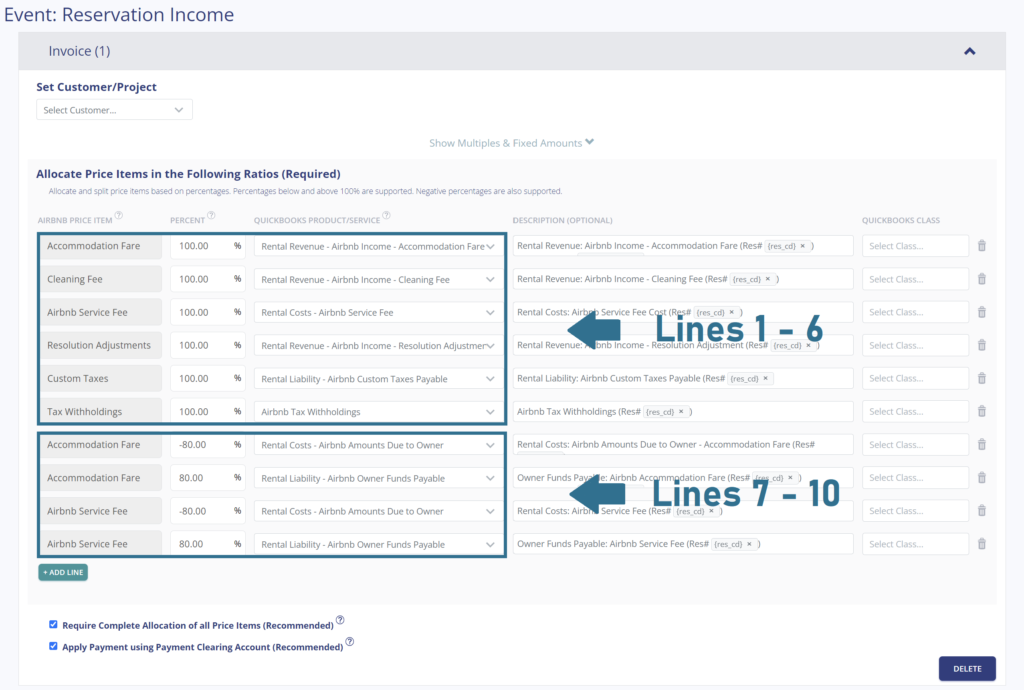

Tallybreeze Listing Presets

Once you connect your Airbnb and QuickBooks account, Tallybreeze (formerly Bnbtally) will guide you through setting up the accounting rules for each listing. When selecting “edit” on a particular property page, Tallybreeze will provide preset options with easy access to pre-made templates that are tailored specifically towards several types of businesses in the industry. After selecting your particular business model for Airbnb Property Management, the presets below can be broken down into two main groups: Lines 1-6 and Lines 7-10.

Explanation of Preset Lines

To learn more about each preset group, click on the corresponding dropdown.

Lines 1-6: All amounts received by Airbnb are 100% allocated as revenue

This group of lines allocates 100% of all income from Airbnb as revenue to the business. This includes the accommodation fare, cleaning fee, Airbnb service fee (subtracted), any resolution adjustments, custom taxes (optional) and tax withholdings (if they exist)

| Airbnb Price Item | % | Account |

|---|---|---|

| Accommodation Fare | 100% | 42100 – Rental Revenue: Airbnb Income – Accommodation Fare |

| Cleaning Fee | 100% | 42200 – Rental Revenue: Airbnb Income – Cleaning Fee |

| Airbnb Service Fee | 100% | 51100 – Rental Costs: Airbnb Service Fee |

| Resolution Adjustment | 100% | 42300 – Rental Revenue: Airbnb Income – Resolution Adjustment |

| Custom Taxes | 100% | 24200 – Rental Liability: Airbnb Custom Taxes Payable |

| Tax Withholdings | 100% | 61100 – Airbnb Tax Withholdings |

Lines 7-10: Allocate 80% of the accommodation fare and service fee as a cost payable to the owner.

This group of lines allocates 80% of the accommodation fare to the owner, it also allocates 80% of the Airbnb service fee, which is subtracted from the amounts owed to the owner.

| Airbnb Price Item | % | Account |

|---|---|---|

| Accommodation Fare | -80% | 51200 – Rental Costs: Airbnb Amounts Due to Owner |

| Accommodation Fare | 80% | 24100 – Rental Liability: Airbnb Owner Funds Payable |

| Airbnb Service Fee | -80% | 51200 – Rental Costs: Airbnb Amounts Due to Owner |

| Airbnb Service Fee | 80% | 24100 – Rental Liability: Airbnb Owner Funds Payable |

Example Reservation

Let’s say you have Tallybreeze set up for this listing using the preset settings above. Let’s say Airbnb sends a payout for a current reservation with the following itinerary price items:

- Accommodation Fare: $2000

- Cleaning Fee: $300

- Airbnb Service Fee: -$60

- Airbnb Transient Occupancy Taxes: $200

- Reservation Total: $2440

First, Tallybreeze accounts for all the income received by Airbnb, separating out each price item. The total amount to be received from Airbnb for this reservation is $2440, which is allocated to the Airbnb Payment Clearing Account to be later reconciled against the resulting bank deposit.

| Account | Debit | Credit |

|---|---|---|

| 42100 – Rental Revenue: Airbnb Income – Accommodation Fare | $2000 | |

| 42200 – Rental Revenue: Airbnb Income – Cleaning Fee | $300 | |

| 51100 – Rental Costs: Airbnb Service Fee | $60 | |

| 24200 – Rental Liability: Airbnb Custom Taxes Payable | $200 | |

| 11000 – Airbnb Payment Clearing Account (Asset) | $2440 |

Next, within the same invoice, Tallybreeze calculates 80% of the Accommodation Fare ($2000 * 80% = $1600) and marks it as a cost payable to the owner. Then, Tallybreeze calculates 80% of the Airbnb Service Fee (-$60 * 80% = -$48), subtracts this amount from the cost and removes it from what’s owed to the owner:

| Account | Debit | Credit |

|---|---|---|

| 51200 – Rental Costs: Airbnb Amounts Due to Owner | $1600 | |

| 24100 – Rental Liability: Airbnb Owner Funds Payable | $1600 | |

| 51200 – Rental Costs: Airbnb Amounts Due to Owner | $48 | |

| 24100 – Rental Liability: Airbnb Owner Funds Payable | $48 |

Finally, on the date the reservation payout is received from Airbnb into your Operations Bank Account (3-5 days later), a bank rule in QuickBooks can automatically reconcile the amount back to the Airbnb Payment Clearing Account:

| Account | Debit | Credit |

|---|---|---|

| 1XXXX – Operations Bank Account | $2440 | |

| 11000 – Airbnb Payment Clearing Account (Asset) | $2440 |

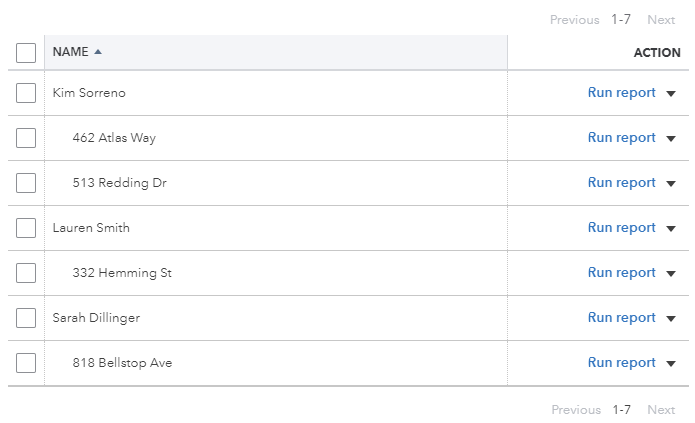

Set Invoice Customer & Class Categories

In your Tallybreeze listings, we recommend to set the owner as the customer for each invoice. We also recommend creating two classes in QuickBooks: one parent class for the owner and another sub-class for the listing. See below example:

Automate Additional Bills & Invoices (Optional)

With Tallybreeze (formerly Bnbtally), you’re also able to automate the creation of additional bills and invoices for each reservation. Consider the following:

- Create a bill to set payouts payable to the property owner for each reservation.

- Create a bill to set amounts payable to a tax authority for each reservation.

- Create a bill to set amounts payable to a cleaning service for turnover of each reservation.

- Create additional invoice to set amounts receivable by any third party for each reservation.

Quick Setup Steps

All of the above settings can be quickly set up using Tallybreeze’s presets for your listings. Here’s how to set up these presets…

- If you haven’t already, Sign Up to Tallybreeze.

- After logging into Tallybreeze, set up your connections, then go to Listing Rules.

- Select any listing you’d like to automate that hasn’t already been set up.

- Select “Load Presets”.

- Select your business model from the options.

From here, presets will be loaded as your listing accounting rules and you can edit as needed.

Airbnb Property Management: Common Transaction Workflows in QuickBooks

In Airbnb Property Management, there’s several other kinds of transactions in QuickBooks which you’ll need to build into your accounting process with owners and various other parties. We’ll list the common workflows in this section.

Paying Owners

To identify how much is owed to an owner, one can look at the balance sheet and filter for each class category under the owner. The amount that needs to be paid pertains specifically under “24100- Rental Liability: Airbnb Owner Funds Payable”.

Example Transaction

You, the Airbnb property management company, are holding funds under “24100 – Rental Liability: Airbnb Owner Funds Payable” account in the amount of $20,000 for the owner, Kim Sorreno, for the listing 462 Atlas Way. You’d like to pay this amount to the owner as a result of a month-end report.

First, you’ll need to send the owner the money via bank transfer, ACH, check or other means. Once the transfer is posted and complete, reconcile the outgoing transaction from the Operations Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $20,000 | Kim Sorreno: 462 Atlas Way | |

| 24100 – Rental Liability: Airbnb Owner Funds Payable | $20,000 | Kim Sorreno: 462 Atlas Way |

Detailed instructions for QuickBooks Online

1. Find the amount to pay

The amount that needs to be paid to each owner can be found in the balance sheet. Filtering the balance sheet by the class for each owner, look up the total amount under “24100 – Rental Liability: Airbnb Owner Funds Payable”.

2. Create Bill

| Vendor | Category | Description | Class |

|---|---|---|---|

| Kim Sorreno | 24100 – Rental Liability: Airbnb Owner Funds Payable | “Owner Payout” | Kim Sorreno: 462 Atlas Way |

- Set Vendor to the name of the owner

- Set Category to “24100 – Rental Liability: Airbnb Owner Funds Payable”

- Set Description to “Owner Payout”

- Set Amount to the balance found in Step 1.

- Set Class to owner’s name and listing

3. Transfer the amount from your operations bank account to the owner

Once you’ve verified the amount, go to your bank and send the money via bank transfer, ACH, check or other means.

4. Reconcile trust bank account amount with bill

Reconcile the bill with the bank feed in QuickBooks

Paying Expenses on Behalf of Owners

There may be situations in which you’ll need to purchase items for the owner’s properties, but the funds come from your operations bank account. This happens when there’s something that needs an immediate fix when a guest checks in – perhaps a smaller maintenance issue. If your contract with the owner allows, you can make the purchase for these items directly from your operations bank account and subtract the paid amount from what’s owed to the owner under “51200 – Rental Costs: Airbnb Amounts Due to Owner”. See example below:

Example

A property owned by Kim Sorreno needs a bathroom faucet to be replaced by a professional plumber. The service costs a total of $200 and needs to be rectified quickly as there are guests checking in later in the day. You also charge a 10% markup for allocating funds and handling these kinds of issues for the owner.

First, you’ll need to pay the plumbing company from your Operations Bank Account either via bank transfer, ACH, check, Venmo or other means. Once the transaction is posted and complete, record the outgoing transaction from your Operations Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $200 | Kim Sorreno: 462 Atlas Way | |

| 7XXXX – Billable Expenses (Expense) | $200 | Kim Sorreno: 462 Atlas Way |

Next, make an entry to deduct the amounts from the amount you owe the owner under “51200 – Rental Costs: Airbnb Amounts Due to Owner”. Include a 10% markup for coordinating & funding the service, and allocate it to your billable expenses income account. Use the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 51200 – Rental Costs: Airbnb Amounts Due to Owner | $220 | Kim Sorreno: 462 Atlas Way | |

| 4XXXX – Billable Expenses Income (Revenue) | $220 | Kim Sorreno: 462 Atlas Way |

Detailed instructions for QuickBooks Online

1. After paying the service provider, categorize and reconcile the transaction in your operations bank feed

| Payee | Category | Description | Amount | Class |

|---|---|---|---|---|

| Plumber Pro | 7XXXX – Billable Expenses (Expense) | “Billable Expense: Bathroom Faucet Replaced” | $200 | Kim Sorreno: 462 Atlas Way |

2. Create a Journal Entry

Include a 10% markup ($220 total)

| Account | Debit | Credit | Description | Name | Class |

|---|---|---|---|---|---|

| 51200 – Rental Costs: Airbnb Amounts Due to Owner | $220 | “Billable Expense: Bathroom Faucet Replaced” | Kim Sorreno | Kim Sorreno: 462 Atlas Way | |

| 4XXXX – Billable Expenses Income (Revenue) | $220 | “Billable Expense: Bathroom Faucet Replaced” | Kim Sorreno | Kim Sorreno: 462 Atlas Way |

Remitting Custom Taxes

Airbnb usually collects transient occupancy taxes and remits them to local tax authorities on your behalf, but you can opt to receive these taxes yourself and have more control over the funds. The Custom Taxes line item in Tallybreeze (formerly Bnbtally) will catch any taxes collected – our presets are designed for this purpose. You can then pay the local tax authority on your own terms following the below example:

Example

The owner, Kim Sorreno, has a listing at 462 Atlas Way, which Airbnb is set up to receive custom taxes for all reservations. In Tallybreeze, these amounts are allocated to “24200 – Rental Liability: Airbnb Custom Taxes Payable”. After running a balance sheet report on this listing in QuickBooks, you see that $1000 is owed for transient occupancy taxes.

First, you’ll need to send your payment to the tax authority either via bank transfer, ACH, check or other means. Once the transaction is posted and complete, record the outgoing transaction from the Operations Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $1,000 | Kim Sorreno: 462 Atlas Way | |

| 24200 – Rental Liability: Airbnb Custom Taxes Payable | $1,000 | Kim Sorreno: 462 Atlas Way |

Detailed instructions for QuickBooks Online

1. Check how much exists in the Custom Taxes Payable account for the owner

The amount that needs to be paid to the tax authority can be found in the balance sheet. Filtering the balance sheet by the class for each owner, look up the total amount under “24200 – Rental Liability: Airbnb Custom Taxes Payable”.

2. Create Bill

| Vendor | Category | Description | Class |

|---|---|---|---|

| Tax Authority | 24200 – Rental Liability: Airbnb Custom Taxes Payable | “Taxes Paid: 11% City TOT” | Kim Sorreno: 462 Atlas Way |

- Set the vendor of the bill to the name of the tax authority

- Set the Product/Service to “24200 – Rental Liability: Airbnb Custom Taxes Payable”

- Set a detailed description, starting with “Taxes: ” and describe the tax

- Set the class to the owner’s name and listing

3. Transfer the amount from your operations bank account to the tax authority

Send the money via bank transfer, ACH, check or other means.

4. Reconcile operations bank account statement line amount with bill

Reconcile the bill with the bank feed in QuickBooks

Monthly Owner Statements & Reports for Airbnb Property Management

Now that we’ve got our data automatically pulled from Airbnb and precisely synced into QuickBooks, the next time you need statements or reports for your business, it’s easy to produce beautiful copies for both owner and internal stakeholders each month.

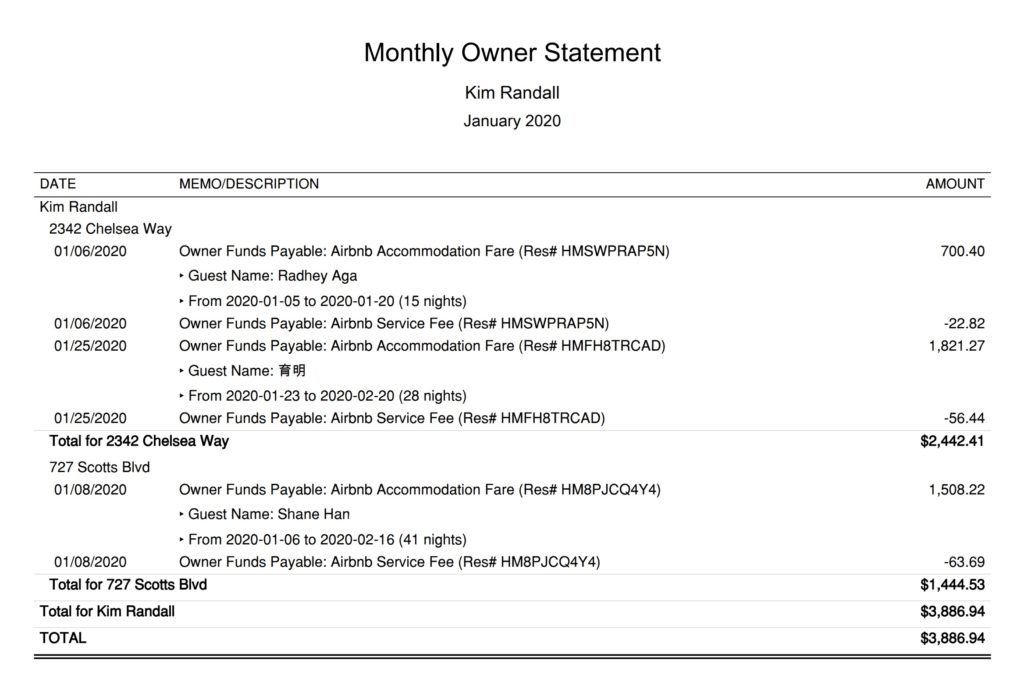

Monthly Owner Statement by Listing

The detailed transaction report below provides a snapshot of what the owner has earned for each listing for the month. This statement can be sent to owners every month, with details grouped by listing, so that they know how their earnings compare for each listing. The example below is an owner statement for Kim Randall, who has two listings:

Quick Setup Steps

Here’s how to create this Owner Statement by Listing in QuickBooks Online:

- In QuickBooks Online, go to Reports, select “Transaction Detail by Account”

- Select the report period (perhaps the previous month)

- Select “Customize” and select the following

- Under “Rows/Columns” select to Group by “Class”

- Select “Change columns” and remove all columns except “Date”, “Memo/Description” and “Amount”

- Under “Filter” select “Distribution Account” and select only the account “Rental Liability: Airbnb Owner Funds Payable”

- Under “Filter” select “Class” and select the owner and their respective listings you want to report

- Sort by “Date” ascending order

- Select “Run Report”

From here this statement can be saved as a custom report and re-used every month for the owner.

Profit & Loss by Customer

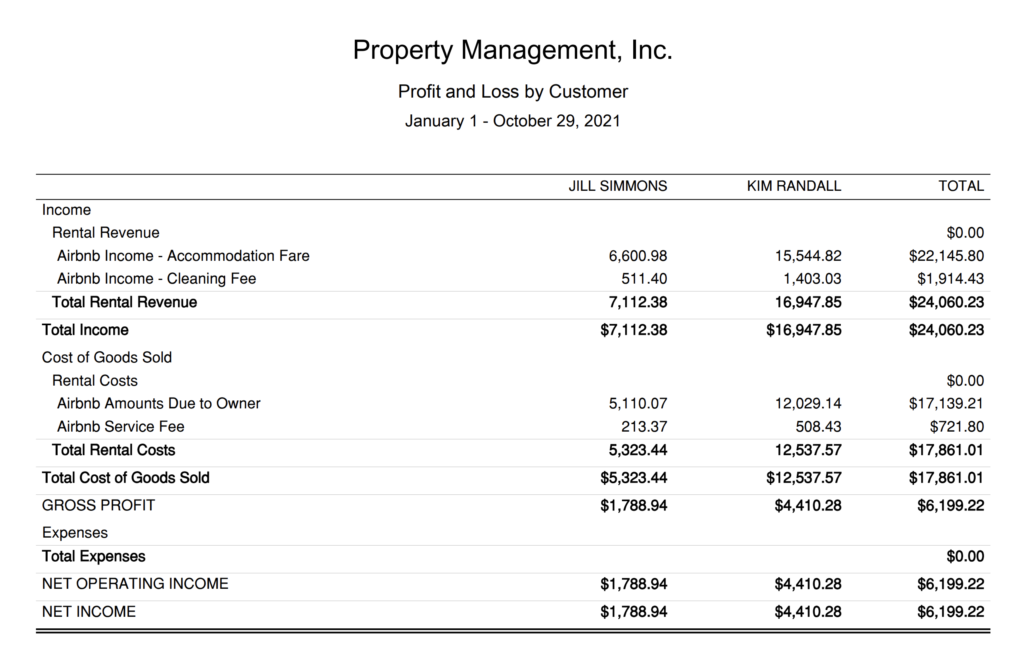

This report is specifically for the Airbnb property manager. This gives a perspective of how much you – as a company – profit or lose on a per listing basis. It gives a clear idea on which kinds of owners you should seek in the future, and which owners you should consider dropping or renegotiating with as an Airbnb property management company. This report is found under QuickBooks “Reports” as “Profit and Loss by Customer”:

Conclusion

Processing the correct numbers to pay each owner requires the highest of integrity and a streamlined accounting process. Many jurisdictions do not require trust accounting, which is why many Airbnb property management companies choose to use the method of accounting discussed in this guide. This accounting method is far simpler to implement than trust accounting, plus all Airbnb revenues are claimed as income to the property management company, which makes it easier to obtain a business loan.

Regardless, this accounting method provides a great deal of transparency to owners. But more importantly, it provides you – the Airbnb property management company – a great deal of transparency into the success of your business. We hope that you’ve received great value from this guide as you build your firm. To begin automating your Airbnb accounting, check the link below:

Finally, there are other business models that are not covered in this guide but are covered better in the following guides. Be sure to check these out :

8 thoughts on “Airbnb Property Management Accounting using QuickBooks”

Comments are closed.