Who should read this guide?

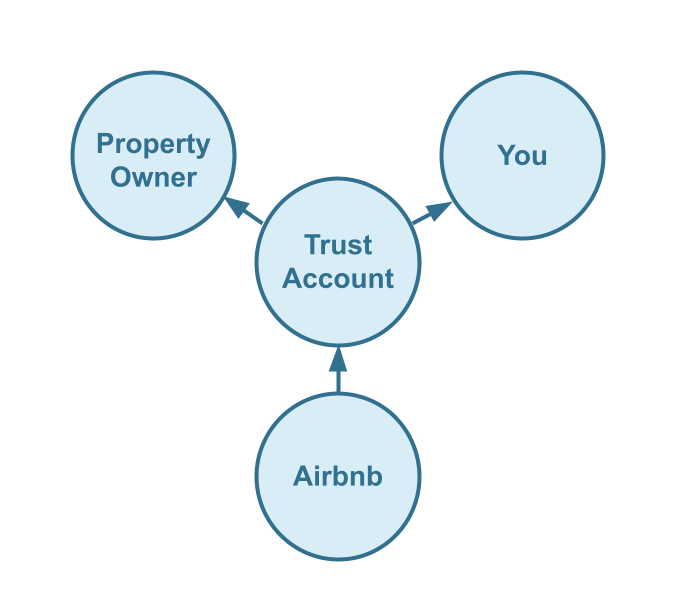

This is a guide about Airbnb trust accounting with QuickBooks for property managers who use a trust account to collect funds from Airbnb on behalf of property owners. This guide is a comprehensive method of accounting for those who need to follow thorough accounting guidelines due to state or local requirements around trust accounts. The trust account itself is delegated by a bank or financial institution for (usually) licensed property managers or real estate brokers to collect funds on behalf of property owners.

In this guide, we assume that QuickBooks Online is your bookkeeping system of choice and all monies collected by Airbnb are transferred directly to the trust bank account. We also assume that you have a separate bank account to handle all other business operations.

NOTE: In this guide, we only cover income accounting, not costs. For a guide about Airbnb costs and chart of accounts to consider, check out this guide instead: Airbnb Costs and Chart of Accounts to Consider

Table of Contents

What you’ll get from this guide:

- A template for QuickBooks with detailed chart of accounts for Airbnb trust accounting

- Learn how to automate Airbnb trust accounting with Tallybreeze

- Execute common transaction workflows in QuickBooks

- Generate monthly owner statements and reports for your clients

Cash Flow Diagram

Who should not read this guide?

There are other business models that may be more suitable in your particular scenario, which are covered better in the following guides:

- Airbnb Property Management Alternative Accounting Method in QuickBooks

- Airbnb Co-Host Accounting in QuickBooks

- Airbnb Arbitrage Accounting in QuickBooks

- Airbnb Investment Accounting in QuickBooks

- All Airbnb templates for QuickBooks

- Airbnb Accounting & Bookkeeping: A Comprehensive Guide

Trust Accounting vs Accounting for your Business

As a part of Airbnb trust accounting, you (the property manager) act under a fiduciary role as a custodian on behalf of property owners. Any funds that you handle on behalf of an owner are considered to be held in trust (What is a trust account?). Given such, many jurisdictions have requirements around managing the accounting and reporting of trust accounts. However, even if your state has no requirements, it’s still a good practice to act as though requirements exist.

Why? Proper Airbnb trust accounting practices provide the most transparency to your owners. Owners love transparency. Transparency makes owners trust you. The more owners trust you, the more they’ll recommend your services to other owners and the greater your business will grow.

Three-Way Trust Reconciliation

The proper reconciliation process for Airbnb trust accounting is known as the three-way trust reconciliation process. This means there are three components that have balances that must be equal when reconciling. These three components are as follows: the trust ledger, the stakeholder ledgers, and the trust bank statement (Source)

- The trust ledger: This is a ledger of all the transactions of the trust account, which you’ll record in QuickBooks Online. In our chart of accounts template, the trust ledger is Trust Account Liability.

- The stakeholder ledgers: The stakeholder ledgers are created by taking the trust ledger a step further, assigning each transaction to a specific stakeholder and grouping together all the trust account activity associated with each individual stakeholder. In our chart of accounts template, under our trust ledger (Trust Account Liability), we separate two primary stakeholders, Owner Funds and Property Mgmt Funds. We’ll also make use of class categories in QuickBooks Online to further separate funds between each of our owners.

- The trust bank statement: This is generated by the bank where the trust account is held and it provides third party verification of the transactions posted to the trust account.

During reconciliation, the trust bank statement balance should match both the trust ledger and the sum of all stakeholder ledger balances – this is the reason it’s called “three-way reconciliation.”

Accounting for your Property Mangement Business

In addition to reconciling the trust ledger and each stakeholder ledgers, the property manager also needs to reconcile their own company ledgers. Property management funds are held in the trust account and are eventually paid from the trust bank account to the property manager’s operating bank account. This will be covered in our guide. Accordingly, in our template, you’ll notice three main sections: Trust Account Asset, Trust Account Liability and Property Mgmt Revenue. Respectively:

- Trust Account Asset: This tracks what’s owed to the property management company from the trust account and should always match the Property Mgmt Funds total within Trust Account Liability.

- Trust Account Liability: This is the trust ledger discussed above.

- Property Mgmt Revenue: This keeps track of all earnings of the property management company, including earnings derived from the trust account.

Airbnb Trust Accounting: QuickBooks Chart of Accounts Template

Building off of our previous sections, here we’ll explain our chart of accounts template in great detail. This is presented in the same structure as we’d create in QuickBooks, with parent categories and their respective sub-categories as follows:

Account Codes

| No. | Account | Type |

|---|---|---|

| 12000 | Trust Account Asset | Asset |

| 12100 | Trust Account Asset: Property Mgmt Funds Reserved | Asset |

| 12200 | Trust Account Asset: Property Mgmt Funds Receivable | Asset |

| 23000 | Trust Account Liability | Liability |

| 23100 | Trust Account Liability: Property Mgmt Funds | Liability |

| 23120 | Trust Account Liability: Property Mgmt Funds: Property Mgmt Funds Reserved | Liability |

| 23140 | Trust Account Liability: Property Mgmt Funds: Property Mgmt Funds Payable | Liability |

| 23300 | Trust Account Liability: Owner Funds | Liability |

| 23310 | Trust Account Liability: Owner Funds: Owner Funds Reserved | Liability |

| 23320 | Trust Account Liability: Owner Funds: Airbnb Collections | Liability |

| 23330 | Trust Account Liability: Owner Funds: Airbnb Collections: Accommodation Fare | Liability |

| 23340 | Trust Account Liability: Owner Funds: Airbnb Collections: Cleaning Fees | Liability |

| 23350 | Trust Account Liability: Owner Funds: Airbnb Collections: Resolution Adjustments | Liability |

| 23360 | Trust Account Liability: Owner Funds: Airbnb Collections: Airbnb Service Fees | Liability |

| 23370 | Trust Account Liability: Owner Funds: Airbnb Collections: Refunds | Liability |

| 23380 | Trust Account Liability: Owner Funds: Airbnb Collections: Custom Taxes Payable | Liability |

| 23390 | Trust Account Liability: Owner Funds: Airbnb Collections: Tax Withholdings | Liability |

| 23400 | Trust Account Liability: Owner Funds: Airbnb Collections: Airbnb Suspense Account | Liability |

| 23500 | Trust Account Liability: Owner Funds: Less Amounts Due to Property Mgmt | Liability |

| 23600 | Trust Account Liability: Owner Funds: Less Owner Payouts | Liability |

| 41000 | Property Mgmt Revenue | Revenue |

| 41100 | Property Mgmt Revenue: Airbnb Commissions | Revenue |

| 41200 | Property Mgmt Revenue: Airbnb Cleaning Fees | Revenue |

NOTE: In this guide, we only cover income accounting, not costs. For a guide about Airbnb costs and chart of accounts to consider, check out this guide instead: Airbnb Costs and Chart of Accounts to Consider

Detailed Explanation of Accounts

Click to expand and learn more about any particular account.

Trust Account Asset

12000 – Trust Account Asset – This account balance should always match “23100 – Trust Account Liability: Property Mgmt Funds”. This is the account for all trust account portions allocated to the property management company in the trust account.

12100 – Trust Account Asset: Property Mgmt Funds Reserved – This account balance should always match “23120 – Trust Account Liability: Property Mgmt Funds: Property Mgmt Funds Reserved”. This account tracks amounts allocated to the property management company in the trust account but are held in reserve within the trust account for funding any issues needing to be paid by the property management company. For example, if you provide a refund to a guest because of something at the fault of the property management company (e.g. to reimburse on a complaint for an unclean listing), this amount should be paid out of the property management company portion of the trust account.

12200 – Trust Account Asset: Property Mgmt Funds Receivable – This account balance should always match “23140 – Trust Account Liability: Property Mgmt Funds: Property Mgmt Funds Payable”. This account tracks amounts due to the property management company from the trust account.

Trust Account Liability

23000 – Trust Account Liability – This account is the trust ledger for three-way trust reconciliation. This account balance, which includes all balances of its child accounts, should match the trust bank account statement balance during reconciliation. This is a ledger of all the transactions flowing into and out of the trust account.

23100 – Trust Account Liability: Property Mgmt Funds – This account is a stakeholder ledger within the trust ledger for three-way trust reconciliation. Also, this ledger balance should always match “12000 – Trust Account Asset”. This stakeholder ledger is specifically for the property management company. This is the account for all trust account portions allocated to the property management company in the trust account.

23120 – Trust Account Liability: Property Mgmt Funds: Property Mgmt Funds Reserved – This account balance should always match “12100 – Trust Account Asset: Property Mgmt Funds Reserved”. This account tracks amounts allocated to the property management company in the trust account but are held in reserve within the trust account for funding any issues needing to be paid by the property management company. For example, if you provide a refund to a guest because of something at the fault of the property management company (e.g. to reimburse on a complaint for an unclean listing), this amount should be paid out of the property management company portion of the trust account.

23140 – Trust Account Liability: Property Mgmt Funds: Property Mgmt Funds Payable – This account balance should always match “12200 – Trust Account Asset: Property Mgmt Funds Receivable”. This account tracks amounts due to the property management company from the trust account.

23300 – Trust Account Liability: Owner Funds – This account is a stakeholder ledger within the trust ledger for three-way trust reconciliation. This stakeholder ledger is specifically for all owners grouped together. Transactions in this ledger should be further classified for each individual owner by the use of class categories within QuickBooks.

23310 – Trust Account Liability: Owner Funds: Owner Funds Reserved – This account tracks amounts allocated to owners in the trust account held in reserve. Rather than being paid out to owners, these amounts are held for funding property maintenance from the trust account.

23320 – Trust Account Liability: Owner Funds: Airbnb Collections – This account tracks all amounts collected from Airbnb in the trust account.

23330 – Trust Account Liability: Owner Funds: Airbnb Collections: Accommodation Fare – This account tracks the accommodation fare portion of each Airbnb reservation. The accommodation fare is equal to the number of nights multiplied by the average nightly rate of each reservation.

23340 – Trust Account Liability: Owner Funds: Airbnb Collections: Cleaning Fees – This account tracks the cleaning fee portion of each Airbnb reservation.

23350 – Trust Account Liability: Owner Funds: Airbnb Collections: Resolution Adjustments – This account tracks any resolution adjustments collected from Airbnb.

23360 – Trust Account Liability: Owner Funds: Airbnb Collections: Airbnb Service Fees – This account tracks service fee costs from Airbnb for each reservation, which is subtracted from Airbnb collections.

23370 – Trust Account Liability: Owner Funds: Airbnb Collections: Refunds – This account tracks refunds executed by Airbnb, which is subtracted from Airbnb collections.

23380 – Trust Account Liability: Owner Funds: Airbnb Collections: Custom Taxes Payable – This account tracks any custom taxes collected from Airbnb and payable to a tax authority from the trust account.

23390 – Trust Account Liability: Owner Funds: Airbnb Collections: Tax Withholdings – This account tracks any taxes withheld by Airbnb for income tax obligations. This is very rare and usually due to the Airbnb account holder lacking tax identification information. Ideally, this account should not contain any balance and is seldom (if ever) used. To avoid income tax withholdings from Airbnb, be sure to update your Airbnb account with your tax identification information and verify your account.

23400 – Trust Account Liability: Owner Funds: Airbnb Collections: Airbnb Suspense Account – This account tracks any income or refund events from Airbnb not tied to any particular reservation or listing. For example, on rare occasions if you receive a credit from Airbnb for referring another host or if you purchase photography from Airbnb. When there’s no associated reservation related to the transaction, there’s no particular listing rules to handle the amounts in Tallybreeze (formerly Bnbtally).

23500 – Trust Account Liability: Owner Funds: Less Amounts Due to Property Mgmt – This account tracks any amounts subtracted from the owner’s portion of the trust account to pay the property management company.

23600 – Trust Account Liability: Owner Funds: Less Owner Payouts – This account tracks any amounts subtracted from the owner’s portion of the trust account to pay the owners.

Property Mgmt Revenue

41000 – Property Mgmt Revenue – This account, along with its child accounts, tracks property management revenues received from the trust account as an income to the property management company.

41100 – Property Mgmt Revenue: Airbnb Commissions – This account tracks Airbnb commissions earned by the property management company.

41200 – Property Mgmt Revenue: Airbnb Cleaning Fees – This account tracks Airbnb cleaning fees earned by the property management company.

Accounts not included in this template

For the scope of this guide, we’re mainly focused on Airbnb revenue recognition and movements within the trust account. It is important to point out that our template does not include many general accounts. We also make reference to some accounts not include in this particular template, which we’ll list here:

- 11000 – Airbnb Payment Clearing Account – This account is created by Tallybreeze (formerly Bnbtally) but is not included in this template in particular. This account is used to apply payments to Airbnb invoices upon the day the Airbnb reservation payout is posted. Payouts can take 3-5 days (or longer) to arrive in the bank account after posted from Airbnb. Monies owed are held in this clearing account until the payouts are received in the bank. This account also helps to automate the reconciliation process in QuickBooks.

- 1XXXX – Trust Bank Account – This is a bank account set up with your financial institution for funds held in trust. It’s a cash asset account solely for the management of owner funds as part of the three-way reconciliation process.

- 1XXXX – Operations Bank Account – This is a separate bank account set up with your financial institution. It’s a cash asset account to facilitate your Airbnb property management company’s day-to-day business operations.

- 4XXXX – Billable Expenses Income – This is a general account for capturing income received for the payment of billable expenses by owners, which may include a markup.

- 7XXXX – Billable Expenses – This is a general account for tracking billable expenses for any owners.

Quick Setup Steps

Here’s how to import the above chart of accounts template. All of the accounts discussed in this article can be imported into QuickBooks automatically using Tallybreeze’s setup tools. Here’s how to access this utility…

- If you haven’t already, Sign Up to Tallybreeze. It includes free use of this template.

- Once registered, go to the Connections manager in Tallybreeze. Connect your Airbnb account, connect your QuickBooks Online account and then create a connection between the two.

- Within the Connection settings, select “Set Up QuickBooks”

- Select your business model from the drop-down list at the top and select “Import Template to QuickBooks”.

How to Automate Airbnb Trust Accounting

Every reservation received from Airbnb can be reconciled automatically – in great detail – using Tallybreeze. Furthermore, all property management commissions can be split and allocated on-the-fly using proper Airbnb trust accounting practices. In this section, we’ll discuss Tallybreeze, it’s approach to automating Airbnb reservation accounting and their presets offered for Airbnb trust accounting, which use the chart of accounts discussed above.

Tallybreeze connects Airbnb to QuickBooks and processes accounting data for each reservation. In Tallybreeze, you’re able to set specific accounting rules for each listing. When a reservation is received from Airbnb, Tallybreeze can create an invoice automatically in QuickBooks Online with all allocations processed to the trust account, including Airbnb collections, property management commissions, cleaning fee allocations and any other split needed.

Tallybreeze Listing Presets for Airbnb Trust Accounting

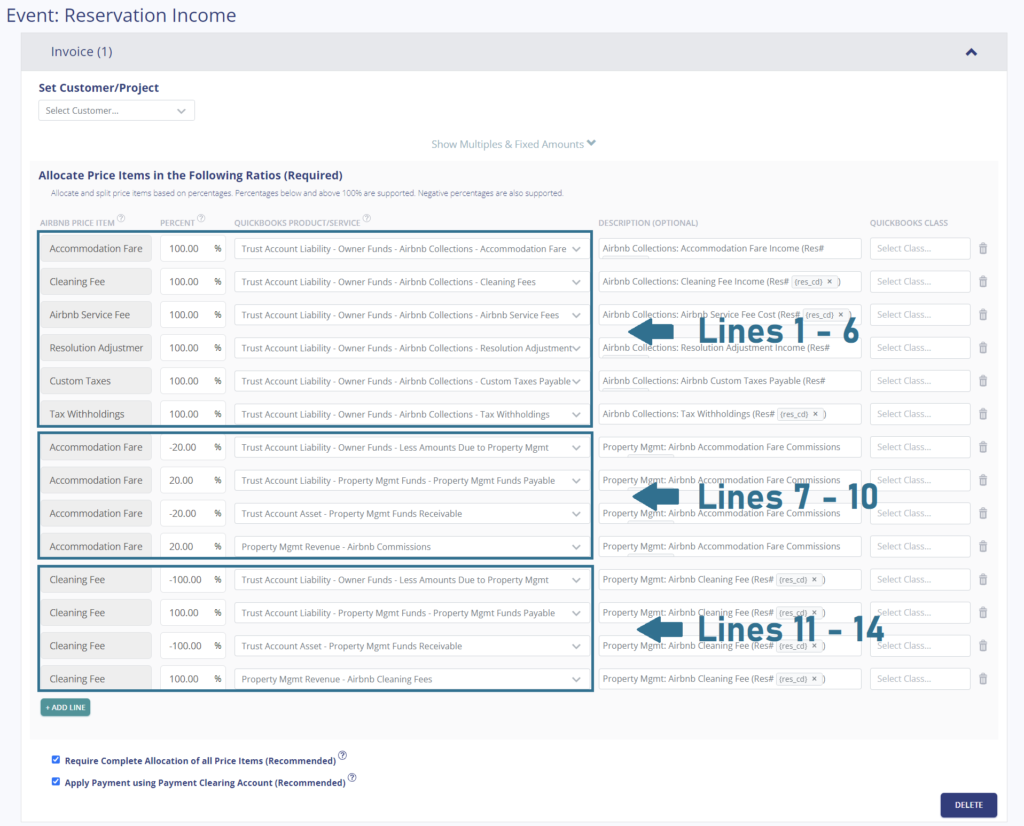

In Tallybreeze, once you’ve connected your Airbnb & QuickBooks account, you’ll then be guided to set up the Airbnb trust accounting rules for each listing. When you select to edit the rules for a particular listing, Tallybreeze will provide presets from our chart of accounts template, which can be loaded to facilitate a quick setup. These presets can be broken down into three groups: Lines 1-6, Lines 7-10 and Lines 11-14.

Explanation of Preset Lines

Click to expand and learn more about each preset.

Lines 1-6: All amounts received by Airbnb are 100% allocated to the owner in the trust account

This group of lines allocates 100% of all income from Airbnb to the owner within the Trust Account Liability under Airbnb Collections. This includes the accommodation fare, cleaning fee, Airbnb service fee (subtracted), any resolution adjustments, custom taxes (optional) and tax withholdings (if they exist)

| Airbnb Price Item | % | Account |

|---|---|---|

| Accommodation Fare | 100% | 23330 – Trust Account Liability: Owner Funds: Airbnb Collections: Accommodation Fare |

| Cleaning Fee | 100% | 23340 – Trust Account Liability: Owner Funds: Airbnb Collections: Cleaning Fees |

| Airbnb Service Fee | 100% | 23360 – Trust Account Liability: Owner Funds: Airbnb Collections: Airbnb Service Fees |

| Resolution Adjustment | 100% | 23350 – Trust Account Liability: Owner Funds: Airbnb Collections: Resolution Adjustments |

| Custom Taxes | 100% | 23380 – Trust Account Liability: Owner Funds: Airbnb Collections: Custom Taxes Payable |

| Tax Withholdings | 100% | 23390 – Trust Account Liability: Owner Funds: Airbnb Collections: Tax Withholdings |

Lines 7-10: A 20% commission is received from the owner to the property manager

This group of lines transfers 20% of the accommodation fare out of the owner funds of the trust account and allocates it to the property manager.

| Airbnb Price Item | % | Account |

|---|---|---|

| Accommodation Fare | -20% | 23500 – Trust Account Liability: Owner Funds: Less Amounts Due to Property Mgmt |

| Accommodation Fare | 20% | 23140 – Trust Account Liability: Property Mgmt Funds: Property Mgmt Funds Payable |

| Accommodation Fare | -20% | 12200 – Trust Account Asset: Property Mgmt Funds Receivable |

| Accommodation Fare | 20% | 41100 – Property Mgmt Revenue: Airbnb Commissions |

Lines 11-14: The entire Airbnb cleaning fee is received from the owner to the property manager

This group of lines transfers 100% of the cleaning fee out of the owner funds of the trust account and allocates it entirely to the property manager.

| Airbnb Price Item | % | Account |

|---|---|---|

| Cleaning Fee | -100% | 23500 – Trust Account Liability: Owner Funds: Less Amounts Due to Property Mgmt |

| Cleaning Fee | 100% | 23140 – Trust Account Liability: Property Mgmt Funds: Property Mgmt Funds Payable |

| Cleaning Fee | -100% | 12200 – Trust Account Asset: Property Mgmt Funds Receivable |

| Cleaning Fee | 100% | 41100 – Property Mgmt Revenue: Airbnb Commissions |

Example Reservation

Let’s say you have Tallybreeze (formerly Bnbtally) set up for this listing using the preset settings above. Let’s say Airbnb sends a payout for a current reservation with the following itinerary price items:

- Accommodation Fare: $2000

- Cleaning Fee: $300

- Airbnb Service Fee: -$60

- Airbnb Transient Occupancy Taxes: $200

- Reservation Total: $2440

First, Tallybreeze accounts for all the income received by Airbnb, separating out each price item. The total amount to be received from Airbnb for this reservation is $2440, which is allocated to the Airbnb Payment Clearing Account to be later reconciled against the resulting bank deposit.

| Account | Debit | Credit |

|---|---|---|

| 23330 – Trust Account Liability: Owner Funds: Airbnb Collections: Accommodation Fare | $2000 | |

| 23340 – Trust Account Liability: Owner Funds: Airbnb Collections: Cleaning Fees | $300 | |

| 23360 – Trust Account Liability: Owner Funds: Airbnb Collections: Airbnb Service Fees | $60 | |

| 23380 – Trust Account Liability: Owner Funds: Airbnb Collections: Custom Taxes Payable | $200 | |

| 11000 – Airbnb Payment Clearing Account (Asset) | $2440 |

Next, Tallybreeze calculates 20% of the Accommodation Fare ($2000 * 20% = $400), reallocates this amount as payable from the trust account and records it as earnings receivable by the property management company:

| Account | Debit | Credit |

|---|---|---|

| 23500 – Trust Account Liability: Owner Funds: Less Amounts Due to Property Mgmt | $400 | |

| 23140 – Trust Account Liability: Property Mgmt Funds: Property Mgmt Funds Payable | $400 | |

| 12200 – Trust Account Asset: Property Mgmt Funds Receivable | $400 | |

| 41100 – Property Mgmt Revenue: Airbnb Commissions | $400 |

Then, Tallybreeze takes 100% of the Cleaning Fee ($400), reallocates this amount as payable from the trust account and records it as earnings receivable by the property management company:

| Account | Debit | Credit |

|---|---|---|

| 23500 – Trust Account Liability: Owner Funds: Less Amounts Due to Property Mgmt | $300 | |

| 23140 – Trust Account Liability: Property Mgmt Funds: Property Mgmt Funds Payable | $300 | |

| 12200 – Trust Account Asset: Property Mgmt Funds Receivable | $300 | |

| 41100 – Property Mgmt Revenue: Airbnb Cleaning Fees | $300 |

Finally, on the date the reservation payout is received from Airbnb into the Trust Bank Account (3-5 days later), a bank rule in QuickBooks can automatically reconcile the amount back to the Airbnb Payment Clearing Account:

| Account | Debit | Credit |

|---|---|---|

| 1XXXX – Trust Bank Account | $2440 | |

| 11000 – Airbnb Payment Clearing Account (Asset) | $2440 |

Set Invoice Customer & Class Categories

Finally, in your Tallybreeze (formerly Bnbtally) listing rules, we recommend to set the owner as the customer of the invoice. We also recommend to set the class category of each line item as “Owner Name: Listing Address” which means you should create two class categories in QuickBooks for this listing, one class category for the owner (set as the parent class) and the other class category for the listing address (set as the sub-class).

Automate Additional Bills & Invoices (Optional)

With Tallybreeze (formerly Bnbtally), you’re also able to automate the creation of additional bills and invoices for each reservation. Consider the following:

- Create a bill to set payouts payable to the property owner for each reservation.

- Create a bill to set amounts payable to a tax authority for each reservation.

- Create a bill to set amounts payable to a cleaning service for turnover of each reservation.

- Create additional invoice to set amounts receivable by any third party for each reservation.

Quick Setup Steps

All of the above settings can be quickly set up using Tallybreeze’s presets for your listings. Here’s how to set up these presets…

- If you haven’t already, Sign Up to Tallybreeze.

- After logging into Tallybreeze, set up your connections, then go to Listing Rules.

- Select any listing you’d like to automate that hasn’t already been set up.

- Select “Load Presets”.

- Select your business model from the options.

From here, presets will be loaded as your listing accounting rules and you can edit as needed.

Execute Common Transaction Workflows in QuickBooks

In this section, we describe the common transaction workflows as needed for Airbnb trust accounting and property management.

Paying the Property Manager (yourself) from the Trust Account

Over the course of a month, an accumulation of commissions occur. The first common transaction workflow to mention is paying yourself, the property manager, from the Trust Bank Account. Assuming you’ve reconciled any expenses, the amount to be paid can be found in the balance sheet under Property Mgmt Funds Payable and Property Mgmt Funds Receivable (both of these account balances should match).

Example Transaction

You, the Airbnb property management company, have funds in the Property Mgmt Funds Receivable account in the amount of $10,000 owed by the owner, Kim Sorreno for listing 462 Atlas Way. You’d like to pay yourself this amount from the trust account.

First, you’ll need to transfer the money between the bank accounts at your financial institution. Once the transfer is posted and complete, record the outgoing transaction from the Trust Bank Account with the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Trust Bank Account (Asset) | $10,000 | Kim Sorreno: 462 Atlas Way | |

| 23140 – Trust Account Liability: Property Mgmt Funds: Property Mgmt Funds Payable | $10,000 | Kim Sorreno: 462 Atlas Way |

Next, record the incoming transaction to your Operating Bank Account with the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $10,000 | Kim Sorreno: 462 Atlas Way | |

| 12200 – Trust Account Asset: Property Mgmt Funds Receivable | $10,000 | Kim Sorreno: 462 Atlas Way |

Detailed instructions for QuickBooks Online

1. Find the amount to pay

Assuming you’ve reconciled any expenses, the amount that needs to be paid can be found in the balance sheet under Property Mgmt Funds Payable or Property Mgmt Funds Receivable (both of these account balances should match).

2. Transfer the amount from the trust bank account to your operations account

Once you’ve verified the amount, go to your bank and transfer this amount from the trust bank account to your business operations bank account.

3. Categorize/reconcile the Trust bank feed transaction in QuickBooks

| Payee | Category | Class |

|---|---|---|

| Your Property Mgmt Company | Property Mgmt Funds Payable | Kim Sorreno: 462 Atlas Way |

- Set the Payee to the name of your property management company

- Set Category to Property Mgmt Funds Payable

- Set the Amount to the balance found under Property Mgmt Funds Payable

- Set the Class to the Owner Name: Listing

4. Transfer/reconcile the Operations bank feed transaction in QuickBooks

Under the Trust Bank Account, find the amount transferred.

- Select “Record as transfer”

- Set Transfer account to Property Mgmt Funds Receivable

Paying Owners from the Trust Account

The next common transaction workflow to identify is paying Owners from the Trust Bank Account. The amount that needs to be paid to each owner can be found in the balance sheet by filtering the class for each owner. The amount can be found under the “Owner Funds” account. You can also cross-check this by looking at the transaction report for any particular month.

Example Transaction

You, the Airbnb property management company, are holding funds under “Owner Funds” in the amount of $20,000 for the owner, Kim Sorreno, for the listing 462 Atlas Way. You’d like to pay this amount to the owner from the trust account as a result of a month-end report.

First, you’ll need to send the owner the money via bank transfer, ACH, check or other means. Once the transfer is posted and complete, record the outgoing transaction from the Trust Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Trust Bank Account (Asset) | $20,000 | Kim Sorreno: 462 Atlas Way | |

| 23600 – Trust Account Liability: Owner Funds: Less Owner Payouts | $20,000 | Kim Sorreno: 462 Atlas Way |

Detailed instructions for QuickBooks Online

1. Find the amount to pay

The amount that needs to be paid to each owner can be found in the balance sheet. Filtering the balance sheet by the class for each owner, look up the total amount under the “Owner Funds” account. You can also cross-check this by looking at the transaction report for any particular time period.

2. Create Bill

| Vendor | Category | Description | Class |

|---|---|---|---|

| Kim Sorreno | Less Owner Payouts | “Owner Payout” | Kim Sorreno: 462 Atlas Way |

- Set Vendor to the name of the owner

- Set Product/Service to Less Owner Payouts

- Set Description to “Owner Payout”

- Set Amount to the balance found in Owner Funds for the specific owner

- Set Class to owner’s name

3. Transfer the amount from the trust bank account to the owner

Once you’ve verified the amount, go to your bank and send the money via bank transfer, ACH, check or other means.

4. Reconcile trust bank account amount with bill

Reconcile the bill with the trust bank feed in QuickBooks

Paying Expenses on Behalf of Owners Directly from the Trust Account

Sometimes an owner may want you to purchase items on their behalf, directly from their funds in the trust account. If it’s a large purchase, such as a new water heater or repair, make sure the owner has enough funds allocated in their Owner Funds Reserved account. If not, you’ll need to allocate funds into this account, else you’ll run the risk of commingling funds of other owners within the trust account and breaking proper Airbnb trust accounting practices.

Example Transaction

The owner, Kim Sorreno, would like you to purchase a new water heater with the funds she has in the trust account for her listing at 462 Atlas Way. The service costs a total of $2000, which includes the installation from a professional maintenance company to complete.

First, you’ll need to pay the maintenance company from the Trust Bank Account either via bank transfer, ACH, check or other means. Once the transaction is posted and complete, record the outgoing transaction from the Trust Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Trust Bank Account (Asset) | $2,000 | Kim Sorreno: 462 Atlas Way | |

| 23310 – Trust Account Liability: Owner Funds: Owner Funds Reserved | $2,000 | Kim Sorreno: 462 Atlas Way |

Detailed instructions for QuickBooks Online

1. Check how much exists in the Owner Funds Reserved account for the owner

Make sure the owner has enough funds allocated in their Owner Funds Reserved account, which you can find in the balance sheet filtered by class. If there’s not enough funds, you’ll need to allocate funds into this account from another trust liability account, else you’ll run the risk of commingling funds of other owners within the trust account.

2. Create Bill

| Vendor | Category | Description | Class |

|---|---|---|---|

| Name of Vendor | Owner Funds Reserved | “Owner Expense: <description>” | Kim Sorreno: 462 Atlas Way |

- Set the vendor of the bill to the one you’re paying the expense to

- Create as many lines as necessary, but set the Product/Service to Owner Funds Reserved

- Set a detailed description for each line, starting with “Owner Expense: ”

- Set the class to the owner’s name and sub-class to the listing

3. Transfer the amount from the trust bank account to the vendor

Send the money via bank transfer, ACH, check or other means.

4. Reconcile trust bank account amount with bill

Reconcile the bill with the trust bank feed in QuickBooks

Paying Expenses on Behalf of Owners from your Operations Bank Account

In many cases you’ll likely purchase items for the owner’s properties from your operations bank account, especially for smaller maintenance issues that need to be fixed quickly. These amounts will be paid back to you after month-end when you report and retrieve the funds back from the trust account.

Example

A property owned by Kim Sorreno needs a bathroom faucet to be replaced by a professional plumber. The service costs a total of $200 and needs to be rectified quickly as there are guests checking in later in the day.

First, you’ll need to pay the plumbing company from your Operations Account either via bank transfer, ACH, check or other means. Once the transaction is posted and complete, record the outgoing transaction from your Operations Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $200 | Kim Sorreno: 462 Atlas Way | |

| 7XXXX – Billable Expenses (Expense) | $200 | Kim Sorreno: 462 Atlas Way |

Next, make an entry for the amounts owed to you from the the trust account so it’ll be included at the next month-end payout. Optionally, include a 10% markup for coordinating and funding the service. Use the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 23500 – Trust Account Liability: Owner Funds: Less Amounts Due to Property Mgmt | $220 | Kim Sorreno: 462 Atlas Way | |

| 23140 – Trust Account Liability: Property Mgmt Funds: Property Mgmt Funds Payable | $220 | Kim Sorreno: 462 Atlas Way | |

| 12200 – Trust Account Asset: Property Mgmt Funds Receivable | $220 | Kim Sorreno: 462 Atlas Way | |

| 4XXXX – Billable Expenses Income (Revenue) | $220 | Kim Sorreno: 462 Atlas Way |

When the next month-end payout occurs, the amount of $220 will be included in the Property Mgmt Funds Receivable and Payable accounts.

Detailed instructions for QuickBooks Online

1. After paying the service provider, categorize and reconcile the transaction in your operations bank feed

| Payee | Category | Description | Amount | Class |

|---|---|---|---|---|

| Plumber Pro | Billable Expenses | “Billable Expense: Bathroom Faucet Replaced” | $200 | Kim Sorreno: 462 Atlas Way |

2. Create a Journal Entry

Include a 10% markup ($220 total)

| Account | Debit | Credit | Description | Name | Class |

|---|---|---|---|---|---|

| Less Amounts to Property Manager (Liability) | $220 | “Billable Expense: Bathroom Faucet Replaced” | Kim Sorreno | Kim Sorreno: 462 Atlas Way | |

| Property Mgmt Funds Payable (Liability) | $220 | “Billable Expense: Bathroom Faucet Replaced” | Kim Sorreno | Kim Sorreno: 462 Atlas Way | |

| Property Mgmt Funds Receivable (Asset) | $220 | “Billable Expense: Bathroom Faucet Replaced” | Kim Sorreno | Kim Sorreno: 462 Atlas Way | |

| Billable Expenses – Income (Revenue) | $220 | “Billable Expense: Bathroom Faucet Replaced” | Kim Sorreno | Kim Sorreno: 462 Atlas Way |

Remitting Taxes from the Trust Account

In many jurisdictions, Airbnb will collect taxes and remit to local tax authorities on the owner’s behalf. However, you can opt to collect these taxes from Airbnb and remit them directly. If you’re using Tallybreeze (formerly Bnbtally), the Custom Taxes line item found in our presets will take care of the allocation of custom taxes for each reservation. This section is about paying the local tax authorities the amounts owed.

Example

The owner, Kim Sorreno, has a listing at 462 Atlas Way, which Airbnb is set up to receive custom taxes for all reservations. In Tallybreeze, these amounts are allocated to the Custom Taxes Payable account. After running a balance sheet report on this listing in QuickBooks, you see that $1000 is owed for transient occupancy taxes under Custom Taxes Payable.

First, you’ll need to send your payment to the tax authority either via bank transfer, ACH, check or other means. Once the transaction is posted and complete, record the outgoing transaction from the Trust Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Trust Bank Account (Asset) | $1,000 | Kim Sorreno: 462 Atlas Way | |

| 23380 – Trust Account Liability: Owner Funds: Airbnb Collections: Custom Taxes Payable | $1,000 | Kim Sorreno: 462 Atlas Way |

Detailed instructions for QuickBooks Online

1. Check how much exists in the Custom Taxes Payable account for the owner

2. Create Bill

| Vendor | Category | Description | Class |

|---|---|---|---|

| Tax Authority | Custom Taxes Payable | “Taxes Paid: 11% City TOT” | Kim Sorreno: 462 Atlas Way |

- Set the vendor of the bill to the the name of the tax authority

- Set the Product/Service to Custom Taxes Payable

- Set a detailed description, starting with “Taxes: ” and describe the tax

- Set the class to the owner’s name

3. Transfer the amount from the trust bank account to the vendor

Send the money via bank transfer, ACH, check or other means.

4. Reconcile trust bank account amount with bill

Reconcile the bill with the trust bank feed in QuickBooks

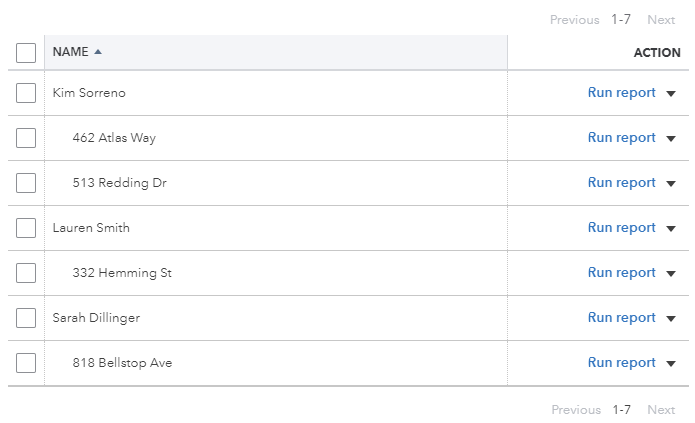

Generate Monthly Owner Statements & Reports

Now that our data is automatically processed from Airbnb and perfectly synced into QuickBooks, once you’ve reconciled any additional expenses, it’s quite simple to produce beautiful owner statements and reports each month.

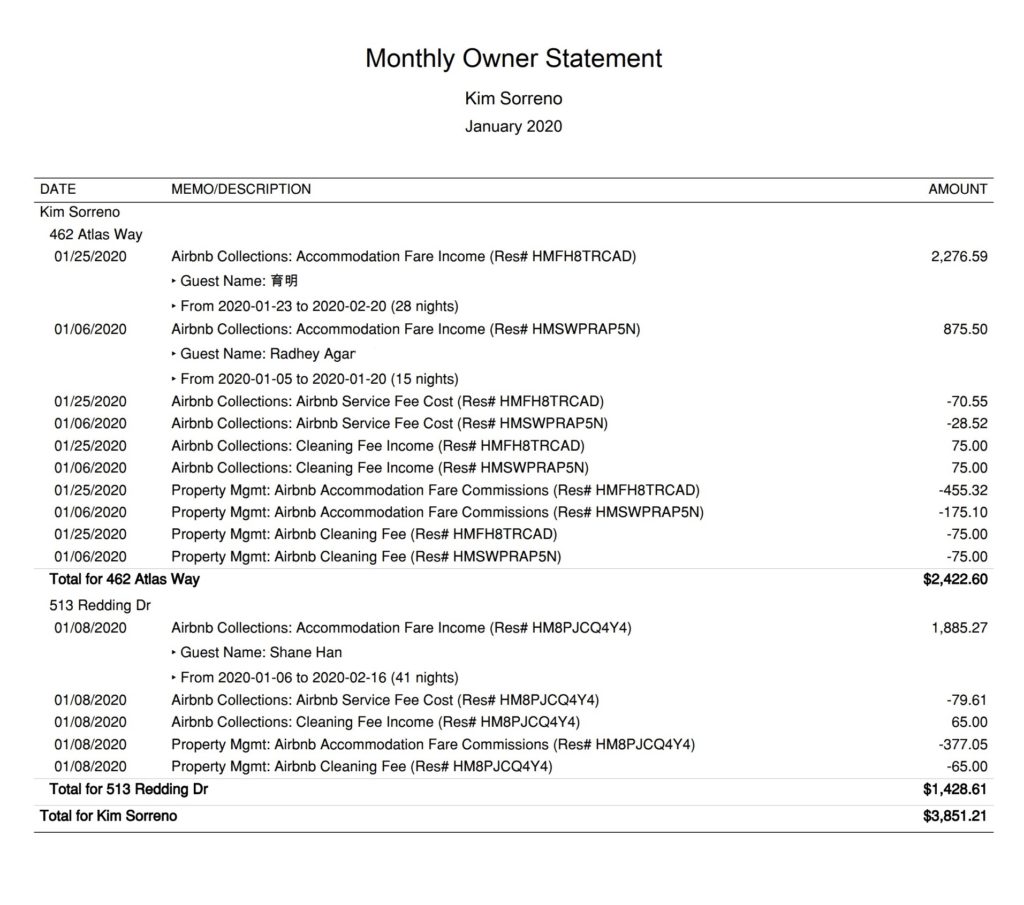

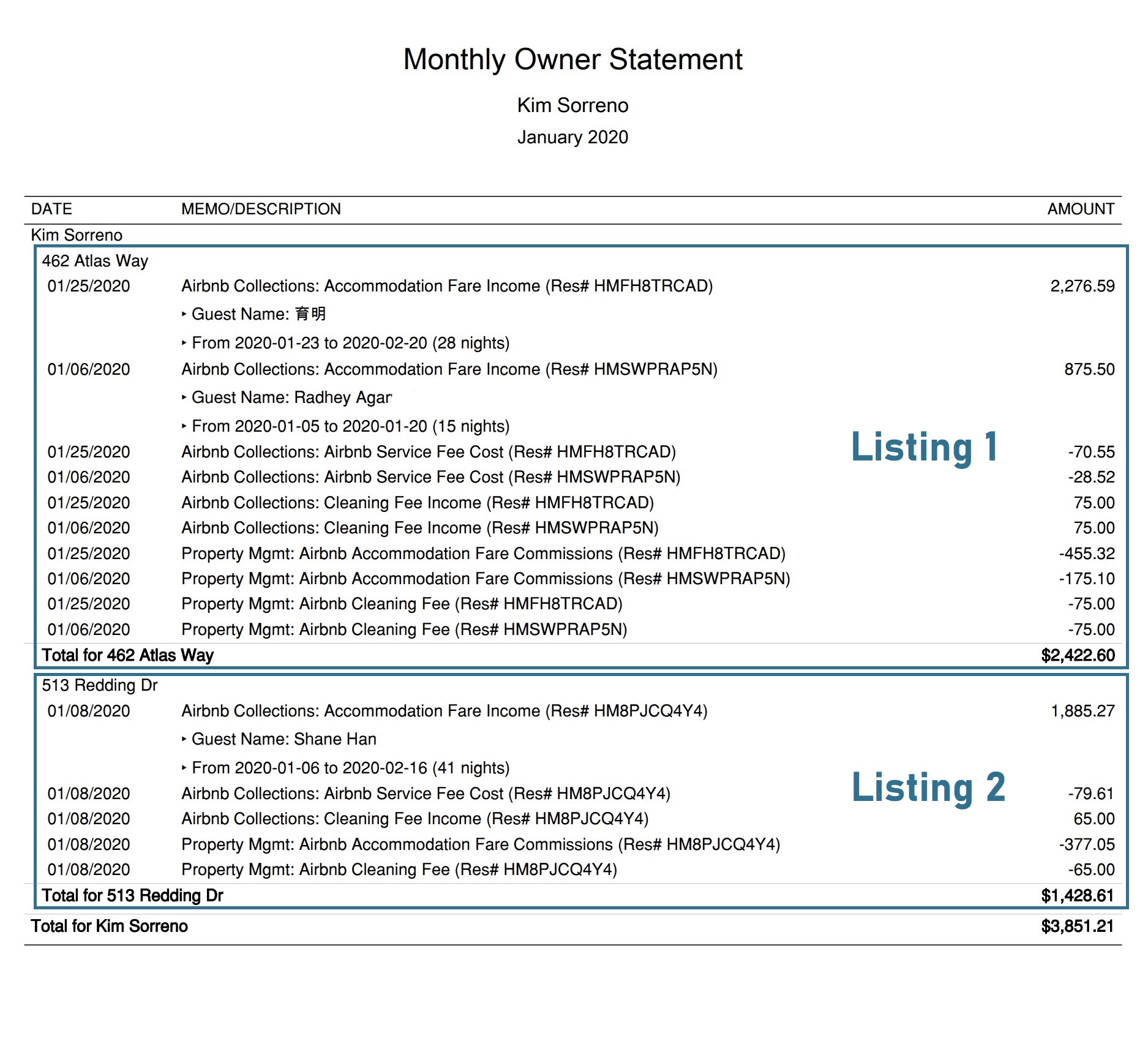

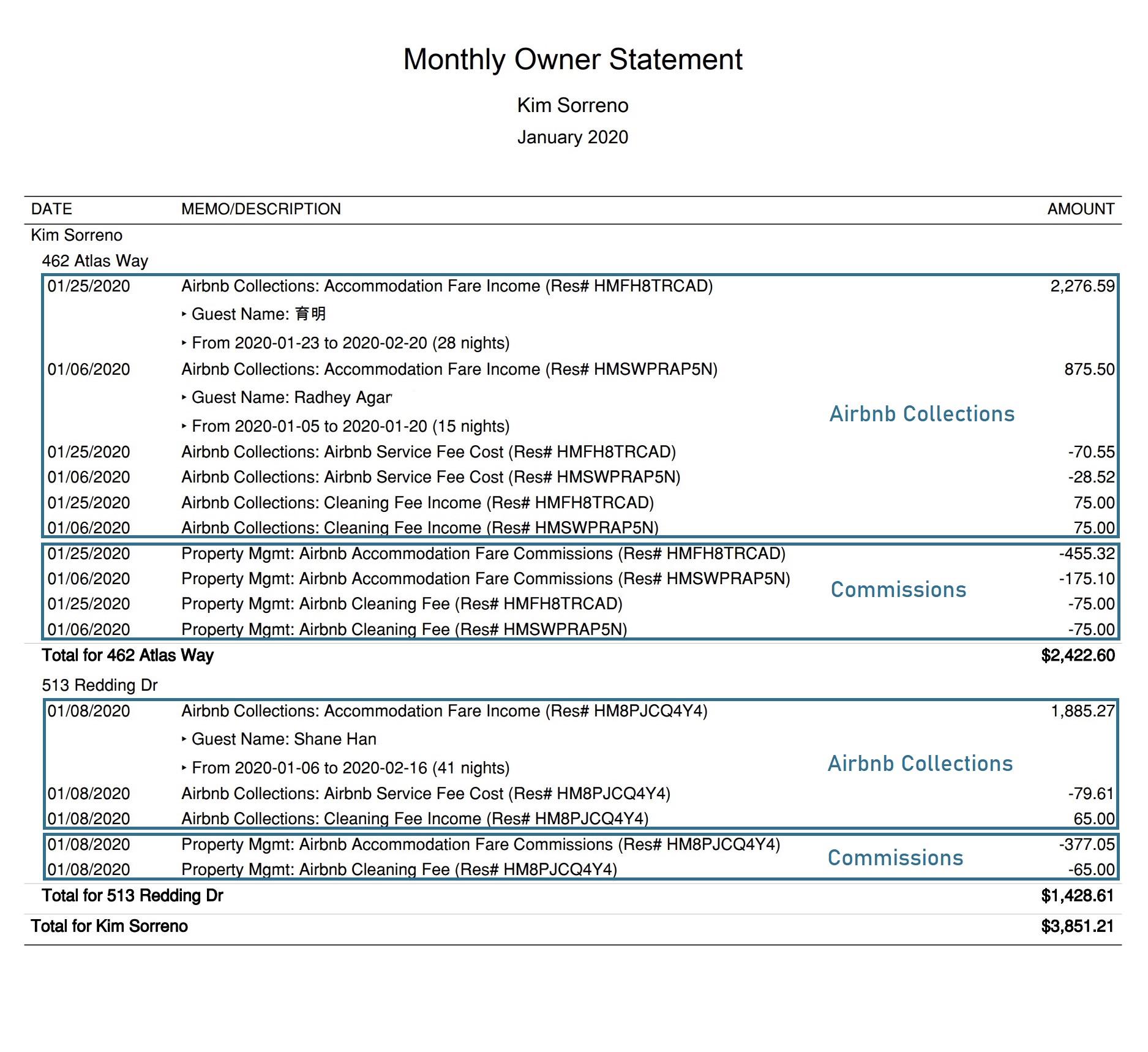

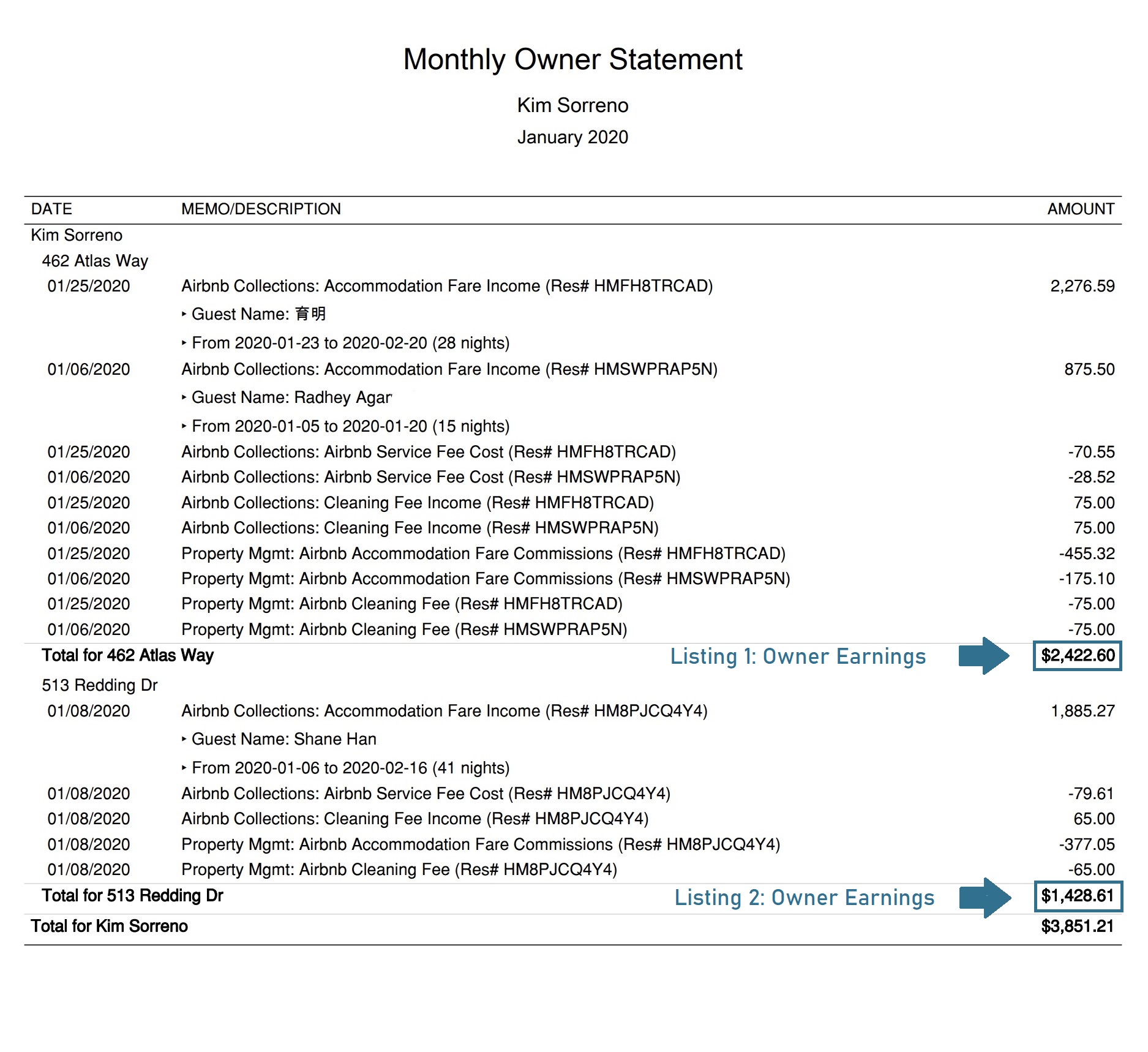

Monthly Owner Statement by Listing

This statement can be sent to owners every month. It is grouped by class, which means it is focused on displaying activity details on a per listing, per owner basis. This helps owners see their earnings, per listing, in precise detail along with all the movements in and out of the trust account. Each line created by Tallybreeze (formerly Bnbtally) includes a reservation code and details of the transaction. Finally, a grand total due to the owner is displayed at the bottom.

In the following example, we’re showing an owner statement for a single owner, Kim Sorreno:

Quick Setup Steps

Here’s how to create this Owner Statement by Listing in QuickBooks Online:

- In QuickBooks Online, go to Reports, select “Transaction Detail by Account”

- Select the report period (perhaps the previous month)

- Select “Customize” and select the following

- Under “Rows/Columns” select to Group by “Class”

- Select “Change columns” and remove all columns except “Date”, “Memo/Description” and “Amount”

- Under “Filter” select “Distribution Account” and select only the accounts starting with “Trust Account Liability:Owner Funds…”

- Under “Filter” select “Class” and select the owner and their respective listings you want to report

- Sort by “Memo/Description” ascending order

- Select “Run Report”

From here this statement can be saved as a custom report and re-used every month for the owner.

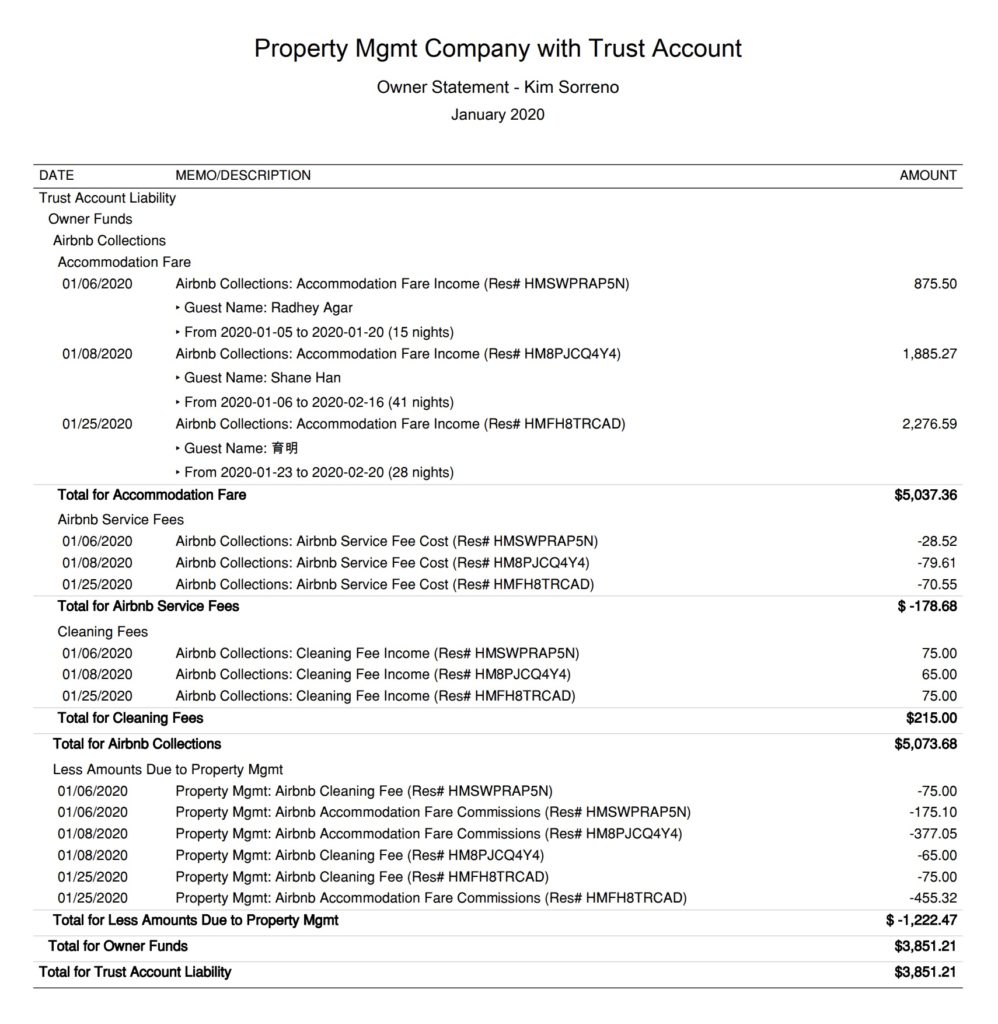

Monthly Owner Statement by Account

If you prefer the owner statement more closely resemble a profit and loss statement, this statement can also be sent to owners every month. It’s similar to the previous statement, except it’s grouped by account (rather than by class). This includes the flow of money coming in from Airbnb, as well as the outflow of money allocated to the property manager for commissions and cleaning fees. If you have any billable expenses, they will also show up in the owner statement as well.

Quick Setup Steps

Here’s how to create this Owner Statement by Account in QuickBooks Online:

- In QuickBooks Online, go to Reports, select “Transaction Detail by Account”

- Select the report period (perhaps the previous month)

- Select “Customize” and select the following

- Under “Rows/Columns” select to Group by “Account”

- Select “Change columns” and remove all columns except “Date”, “Memo/Description” and “Amount”

- Under “Filter” select “Distribution Account” and select only the accounts starting with “Trust Account Liability:Owner Funds…”

- Under “Filter” select “Class” and select the owner and their respective listings you want to report

- Sort by “Date” ascending order

- Select “Run Report”

From here this statement can be saved as a custom report and re-used every month for the owner.

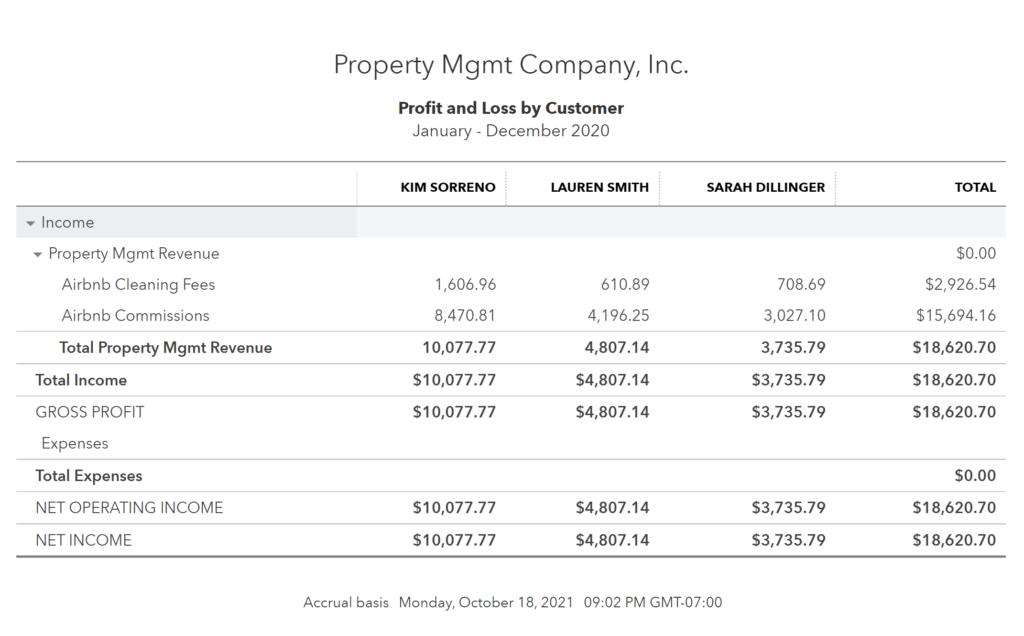

Profit & Loss by Customer

Having all Airbnb trust accounting activity separate from your company operations activity makes it’s easy to generate a profit & loss report on the fly to see how much you’re earning from each customer over any period. This report is found under QuickBooks “Reports” as “Profit and Loss by Customer”:

Conclusion

Managing other peoples funds with the highest integrity requires a great deal of diligence. However, even if you’re not legally required, following Airbnb trust accounting standards has a material impact on how your clients view your services. Proper Airbnb trust accounting provides the most transparency to your owners. Transparency makes owners trust you. The more owners trust you, the more they’ll recommend your services to others. And with an automated solution, you’ll be ready to scale quickly as you grow.

We hope that you’ve received great value from this guide as you build your firm. To begin automating your Airbnb trust accounting, check the link below:

Finally, there are other business models that are not covered in this guide but are covered better in the following guides. Be sure to check these out :

7 thoughts on “Airbnb Trust Accounting for Property Managers using QuickBooks”

Comments are closed.