Who should read this guide?

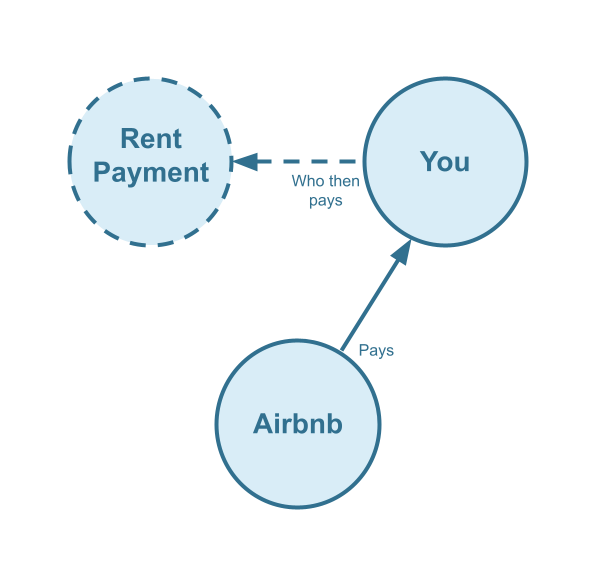

This is an accounting guide for those operating Airbnb Arbitrage listings and who use QuickBooks accounting software. Airbnb Arbitrage is a business model where an operator rents a property from an owner on a master lease and subleases said property to guests on Airbnb. This business model thrives in markets where Airbnb short-term income potential is higher than local long-term rental prices. Keeping a close eye on your numbers with an automated accounting system will make a great difference in navigating the success of your operations. In this guide, you’ll learn how to implement and automate accounting for the Airbnb Arbitrage business model using QuickBooks.

NOTE: In this guide, we only cover income accounting, not costs. For a guide about Airbnb costs and chart of accounts to consider, check out this guide instead: Airbnb Costs and Chart of Accounts to Consider

About Airbnb Arbitrage

The benefits of the Airbnb Arbitrage business model are several. First, in markets where Airbnb travel is trending and local long-term rental rates are low, the Airbnb Arbitrage operator can stand to gain 30-50% gross profit margins (some areas even greater), which is much higher than the standard 15-20% Airbnb property management commission-based model. Second, the Airbnb Arbitrage operator has greater control over the property since the operator is a tenant with legal possession of the property. This means there’s much less overhead in dealing with the owner, the operator does not need to report monthly financials, they just pay rent to the owner and the operator has the most freedom to operate without actually owning the property.

The downside of this business model is the risk of the lease itself. In a market downturn, or in a market where travel becomes jeopardized this may not be favorable. If revenues start to dry up, margins can become slim as you continue to make fixed rental payments. Then in good times, unless mitigations are implemented in the master lease, the owner may increase the rent, also eating into the operator’s profit margins. The operator is also usually the one who purchases all the furnishings and fixtures for the property, taking on greater upfront costs than a property manager, who may share or completely pass these costs onto the property owner.

Table of Contents

Here’s what you’ll get from this guide:

- A template for QuickBooks with detailed chart of accounts for Airbnb arbitrage

- Learn how to automate Airbnb arbitrage accounting with Bnbtally

- Execute common transaction workflows in QuickBooks

- Generate monthly reports for you and your firm

Cash Flow Diagram

Who should not read this guide?

There are other business models that may be more suitable in your particular scenario, which are covered better in the following guides:

- Airbnb Co-Host Accounting in QuickBooks

- Airbnb Investment Accounting in QuickBooks

- Trust Accounting for Airbnb Property Managers in QuickBooks

- Airbnb Property Management Alternative Accounting Method in QuickBooks

- All Airbnb templates for QuickBooks

- Airbnb Accounting & Bookkeeping: A Comprehensive Guide

Airbnb Arbitrage: QuickBooks Chart of Accounts for Airbnb Income

In this section, we’ll go over the details of our QuickBooks chart of accounts template for the Airbnb arbitrage business model:

Account Codes

| No. | Account | Type |

|---|---|---|

| 24000 | Rental Liability | Liability |

| 24200 | Rental Liability: Airbnb Custom Taxes Payable | Liability |

| 42000 | Rental Revenue | Revenue |

| 42100 | Rental Revenue: Airbnb Income – Accommodation Fare | Revenue |

| 42200 | Rental Revenue: Airbnb Income – Cleaning Fee | Revenue |

| 42300 | Rental Revenue: Airbnb Income – Resolution Adjustment | Revenue |

| 42400 | Rental Revenue: Airbnb Refund – Accommodation Fare | Revenue |

| 42500 | Rental Revenue: Airbnb Refund – Cleaning Fee | Revenue |

| 42600 | Rental Revenue: Airbnb Refund – Resolution Adjustment | Revenue |

| 51000 | Rental Costs | Cost of Service |

| 51100 | Rental Costs: Airbnb Service Fee | Cost of Service |

| 61100 | Airbnb Tax Withholdings | Expense |

NOTE: In this guide, we only cover income accounting, not costs. For a guide about Airbnb costs and chart of accounts to consider, check out this guide instead: Airbnb Costs and Chart of Accounts to Consider

Detailed Explanation of Accounts

To learn more about each specific account code, we’ve listed each definition here:

Rental Liability

24000 – Rental Liability – This is a parent account with child accounts that account for rental liabilities.

24200 – Rental Liability: Airbnb Custom Taxes Payable – This represents all Custom Taxes collected from Airbnb and payable to a tax authority.

Rental Revenue

42000 – Rental Revenue – This is a parent account with child accounts that account for rental revenue.

42100 – Rental Revenue: Airbnb Income – Accommodation Fare – This account tracks the accommodation fare portion of each Airbnb reservation. The accommodation fare is equal to the number of nights multiplied by the average nightly rate of each reservation.

42200 – Rental Revenue: Airbnb Income – Cleaning Fee – This account tracks the cleaning fee portion of each Airbnb reservation.

42300 – Rental Revenue: Airbnb Income – Resolution Adjustment – This account tracks any resolution adjustments collected from Airbnb.

42400 – Rental Revenue:Airbnb Refund – Accommodation Fare – This account tracks accommodation fare refunds executed by Airbnb.

42500 – Rental Revenue: Airbnb Refund – Cleaning Fee – This account tracks cleaning fee refunds executed by Airbnb.

42600 – Rental Revenue: Airbnb Refund – Resolution Adjustment – This account tracks resolution adjustment refunds executed by Airbnb.

Rental Costs

51000 – Rental Costs – This is a parent account with child accounts that account for rental costs.

51100 – Rental Costs: Airbnb Service Fee – This account tracks service fee costs from Airbnb for each reservation, which is subtracted from the income.

61100 – Airbnb Tax Withholdings – This account tracks any taxes withheld by Airbnb for income tax obligations. This is very rare and usually due to the Airbnb account holder lacking tax identification information. Ideally, this account should not contain any balance and is seldom (if ever) used. To avoid income tax withholdings from Airbnb, be sure to update your Airbnb account with your tax identification information and verify your account.

Accounts not included in this template

For the scope of this guide, we’re mainly focused on Airbnb revenue recognition. It is important to point out that our template does not include many general accounts. We also make reference to some accounts not included in this particular template, which we’ll list here:

- 11000 – Airbnb Payment Clearing Account – This account is created by Bnbtally but is not included in this template in particular. This account is used to apply payments to Airbnb invoices upon the day the Airbnb reservation payout is posted. Payouts can take 3-5 days (or longer) to arrive in the bank account after posted from Airbnb. Monies owed are held in this clearing account until the payouts are received in the bank. This account also helps to automate the reconciliation process in QuickBooks.

- 1XXXX – Operations Bank Account – This is your business operations bank account set up with your financial institution. It’s a cash asset account to facilitate your Airbnb Arbitrage day-to-day business operations.

- 5XXXX – Master Lease Rent Payments – This is an account used to track the amounts you’re paying to owners for master leases.

- 4XXXX – Billable Expenses Income – This is a general account for capturing income received for the payment of billable expenses by owners, which may include a markup.

- 7XXXX – Billable Expenses – This is a general account for tracking billable expenses for any owners.

Quick Setup Steps

Here’s how to import the above chart of accounts template. The chart of accounts discussed in this article can be imported into QuickBooks automatically using Bnbtally’s setup tools. Here’s how to access this utility…

- If you haven’t already, Sign Up to Bnbtally. It includes free use of this template.

- Once registered, go to the Connections manager in Bnbtally. Connect your Airbnb account, connect your QuickBooks Online account and then create a connection between the two.

- Within the Connection settings, select “Set Up QuickBooks”

- Select your business model from the drop-down list at the top and select “Import Template to QuickBooks”.

How to Automate Airbnb Arbitrage Accounting

With Bnbtally, you can automate your Airbnb arbitrage accounting so that you can focus on building a more profitable business. We’ll discuss how to use the preset settings in this section, which are designed for syncing reservations for an Airbnb arbitrage business model. Here we’ll make use of the chart of accounts discussed above.

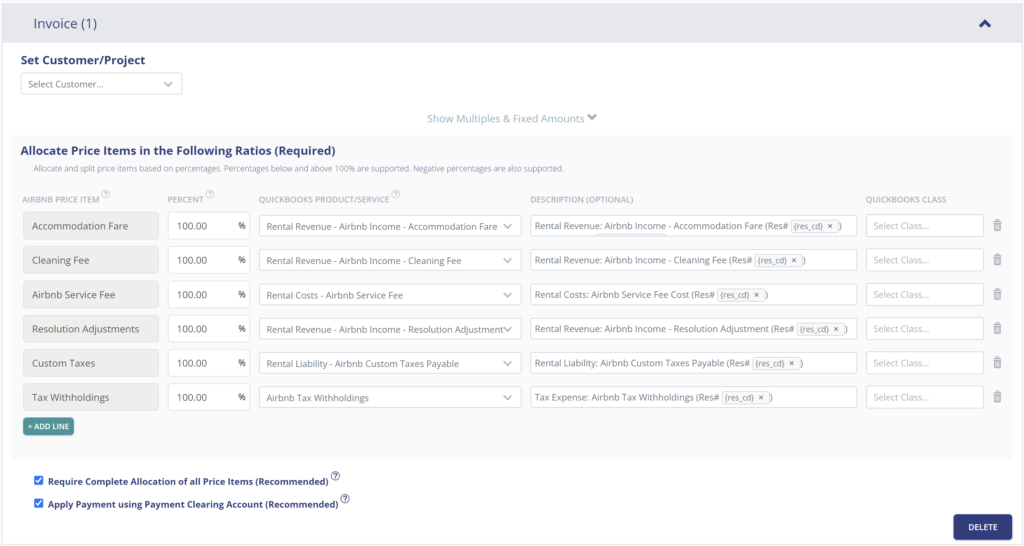

Bnbtally Listing Presets

Once you’ve connected your Airbnb and QuickBooks accounts, Bnbtally will guide you through setting up the accounting rules for your Airbnb arbitrage listing. You can also edit these presets if needed before enabling them for automation.

Explanation of Preset Lines

100% of all income from Airbnb is allocated as revenue to the business. This includes the accommodation fare, cleaning fee, Airbnb service fee (subtracted), any resolution adjustments, custom taxes (optional) and tax withholdings (if they exist)

| Airbnb Price Item | % | Account |

|---|---|---|

| Accommodation Fare | 100% | 42100 – Rental Revenue: Airbnb Income – Accommodation Fare |

| Cleaning Fee | 100% | 42200 – Rental Revenue: Airbnb Income – Cleaning Fee |

| Airbnb Service Fee | 100% | 51100 – Rental Costs: Airbnb Service Fee |

| Resolution Adjustment | 100% | 42300 – Rental Revenue: Airbnb Income – Resolution Adjustment |

| Custom Taxes | 100% | 24200 – Rental Liability: Airbnb Custom Taxes Payable |

| Tax Withholdings | 100% | 61100 – Airbnb Tax Withholdings |

Example Reservation

Let’s say you have Bnbtally set up for this listing using the preset settings above. Let’s say Airbnb sends a payout for a current reservation with the following itinerary price items:

- Accommodation Fare: $2000

- Cleaning Fee: $300

- Airbnb Service Fee: -$60

- Airbnb Transient Occupancy Taxes: $200

- Reservation Total: $2440

Bnbtally accounts for all the income received by Airbnb, separating out each price item. The total amount to be received from Airbnb for this reservation is $2440, which is allocated to the Airbnb Payment Clearing Account to be later reconciled against the resulting bank deposit.

| Account | Debit | Credit |

|---|---|---|

| 42100 – Rental Revenue: Airbnb Income – Accommodation Fare | $2000 | |

| 42200 – Rental Revenue: Airbnb Income – Cleaning Fee | $300 | |

| 51100 – Rental Costs: Airbnb Service Fee | $60 | |

| 24200 – Rental Liability: Airbnb Custom Taxes Payable | $200 | |

| 11000 – Airbnb Payment Clearing Account (Asset) | $2440 |

Finally, on the date the reservation payout is received from Airbnb into your Operations Bank Account (3-5 days later), a bank rule in QuickBooks can automatically reconcile the amount back to the Airbnb Payment Clearing Account:

| Account | Debit | Credit |

|---|---|---|

| 1XXXX – Operations Bank Account | $2440 | |

| 11000 – Airbnb Payment Clearing Account (Asset) | $2440 |

Set Invoice Customer & Class Categories

The best way to manage your guests in QuickBooks is by creating a general customer in QuickBooks for these transactions, we recommend calling it “Airbnb Guests”. However, if you prefer, you can set the guest as the customer in Bnbtally. In such case we’ll create each guest as a customer in QuickBooks and will set them as the customer of the invoice for each reservation.

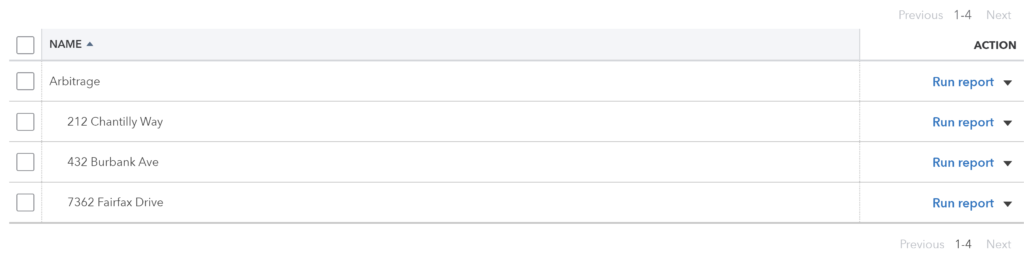

If you have more than one listing, you’ll also want to create a class category for each listing in QuickBooks, many users will literally name the class category using the address of the listing. Then we recommend to place each listing class category under a parent class category called “Arbitrage”. Click below to see an example:

Automate Additional Bills & Invoices (Optional)

With Bnbtally, you’re also able to automate the creation of additional bills and invoices for each reservation. Consider the following:

- Create a bill to set amounts payable to a tax authority for each reservation.

- Create a bill to set amounts payable to a cleaning service for turnover of each reservation.

- Create additional invoice to set amounts receivable by any third party for each reservation.

Quick Setup Steps

All of the above settings can be quickly set up using Bnbtally’s presets for your listings. Here’s how to set up these presets…

- If you haven’t already, Sign Up to Bnbtally.

- After logging into Bnbtally, set up your connections, then go to Listing Rules.

- Select any listing you’d like to automate that hasn’t already been set up.

- Select “Load Presets”.

- Select your business model from the options.

From here, presets will be loaded as your listing accounting rules and you can edit as needed.

Airbnb Arbitrage: Common Transaction Workflows in QuickBooks

The following is a list of common transaction workflows for Airbnb Arbitrage in QuickBooks.

Paying Rent to Owners

Owners receive a fixed rent each month, which means it’s easy to create a recurring payment. Each rent payment can be reconciled to “5XXXX – Master Lease Rent Payments”.

Example Transaction

You, the Airbnb Arbitrage operator, are paying the owner, Claudia Smith, $2000 rent per month for the property located at 212 Chantilly Way through a recurring bank transaction which happens monthly. Once the transfer is posted and complete, reconcile the outgoing transaction from the Operations Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $2,000 | Arbitrage: 212 Chantilly Way | |

| 5XXXX – Master Lease Rent Payments (Cost) | $2,000 | Arbitrage: 212 Chantilly Way |

Detailed instructions for QuickBooks Online

1. Create a Recurring Bill

| Vendor | Category | Description | Class |

|---|---|---|---|

| Claudia Smith | 5XXXX – Master Lease Rent Payments | “Master Lease Rent Payment” | Arbitrage: 212 Chantilly Way |

- Set Vendor to the name of the owner “Claudi Smith”

- Set Category to “5XXXX – Master Lease Rent Payments”

- Set Description to “Master Lease Rent Payment”

- Set Amount to the rent amount

- Set Class to the listing address

2. Pay the Bill

Pay the Bill directly in QuickBooks or reconcile the Bill against the payment made in your bank feed.

Paying Expenses on Behalf of Owners

If you need to purchase maintenance items and pay for it quickly, you may need to do so with the funds in your operations bank account. If your rental agreement allows, when rent is due again after paying off this expense, remove those additional monies from next month’s payment going towards landowner(s).

Example

A property owned by Claudia Smith needs a bathroom faucet to be replaced by a professional plumber. The service costs a total of $200 and needs to be rectified quickly as there are guests checking in later in the day. You also charge a 20% markup for allocating funds and administering the service for the owner.

First, you’ll need to pay the plumbing company from your Operations Bank Account either via bank transfer, ACH, check, Venmo or other means. Once the transaction is posted and complete, record the outgoing transaction from your Operations Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $200 | Arbitrage: 212 Chantilly Way | |

| 7XXXX – Billable Expenses (Expense) | $200 | Arbitrage: 212 Chantilly Way |

When you pay your next rent payment (rent is $2000), subtract the amount billed plus a 20% markup. This equals a payment of $1760 ($2000 – $240 = $1760). Once the transaction is posted and complete, record the outgoing transaction from the Operations Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $1760 | Arbitrage: 212 Chantilly Way | |

| 5XXXX – Master Lease Rent Payments (Cost) | $2000 | Arbitrage: 212 Chantilly Way | |

| 4XXXX – Billable Expenses Income (Revenue) | $240 | Arbitrage: 212 Chantilly Way |

Detailed instructions for QuickBooks Online

1. After paying the service provider, categorize and reconcile the transaction in your operations bank feed

| Payee | Category | Description | Amount | Class |

|---|---|---|---|---|

| Plumber Pro | 7XXXX – Billable Expenses (Expense) | “Billable Expense: Bathroom Faucet Replaced” | $200 | Arbitrage: 212 Chantilly Way |

2. Subtract amount when making the next rent payment and reconcile as follows

Rent is $2000. Upon payment, subtract the amount billed plus a 20% markup. This equals a payment of $1760 ($2000 – $240 = $1760). Once the transaction is posted and complete, record the outgoing transaction from the Operations Bank Account using the following entry:

| Payee | Category | Description | Amount | Class |

|---|---|---|---|---|

| Claudia Smith (Owner) | 5XXXX – Master Lease Rent Payments (Cost) | “Rent Payment for 212 Chantilly Way” | $2000 | Arbitrage: 212 Chantilly Way |

| Claudia Smith (Owner) | 4XXXX – Billable Expenses Income (Revenue) | “Billable Expense: Bathroom Faucet Replaced” | -$240 | Arbitrage: 212 Chantilly Way |

Remitting Custom Taxes

In most areas, Airbnb will help collect taxes and remit them to your tax authority on your behalf. In such case, you can skip this section. But if you want more control over your funds, you should choose to receive custom taxes directly from Airbnb and remit them yourself. If you go this route in Airbnb, Bnbtally will automatically allocate any custom taxes associated with each reservation using the Custom Taxes line in our preset. You can then pay out to the tax authority following the example below.

Example

The listing, 462 Atlas Way, is set up on Airbnb to receive custom taxes for all reservations. In Bnbtally, these amounts are allocated to “24200 – Rental Liability: Airbnb Custom Taxes Payable”. After running a balance sheet report on this listing in QuickBooks, you see that $200 is owed for transient occupancy taxes.

First, you’ll need to send your payment to the tax authority either via bank transfer, ACH, check or other means. Once the transaction is posted and complete, record the outgoing transaction from the Operations Bank Account using the following entry:

| Debit | Credit | Class Category | |

|---|---|---|---|

| 1XXXX – Operations Bank Account (Asset) | $200 | Arbitrage: 212 Chantilly Way | |

| 24200 – Rental Liability: Airbnb Custom Taxes Payable | $200 | Arbitrage: 212 Chantilly Way |

Detailed instructions for QuickBooks Online

1. Check how much exists in the Custom Taxes Payable account for the owner

The amount that needs to be paid to the tax authority can be found in the balance sheet. Filtering the balance sheet by the class for each listing, look up the total amount under “24200 – Rental Liability: Airbnb Custom Taxes Payable”.

2. Create Bill

| Vendor | Category | Description | Class |

|---|---|---|---|

| Tax Authority | 24200 – Rental Liability: Airbnb Custom Taxes Payable | “Taxes Paid: 11% City TOT” | Arbitrage: 212 Chantilly Way |

- Set the vendor of the bill to the name of the tax authority

- Set the Product/Service to “24200 – Rental Liability: Airbnb Custom Taxes Payable”

- Set a detailed description, starting with “Taxes: ” and describe the tax

- Set the class to the listing

3. Transfer the amount from your operations bank account to the tax authority

Send the money via bank transfer, ACH, check or other means.

4. Reconcile operations bank account statement line amount with bill

Reconcile the bill with the bank feed in QuickBooks

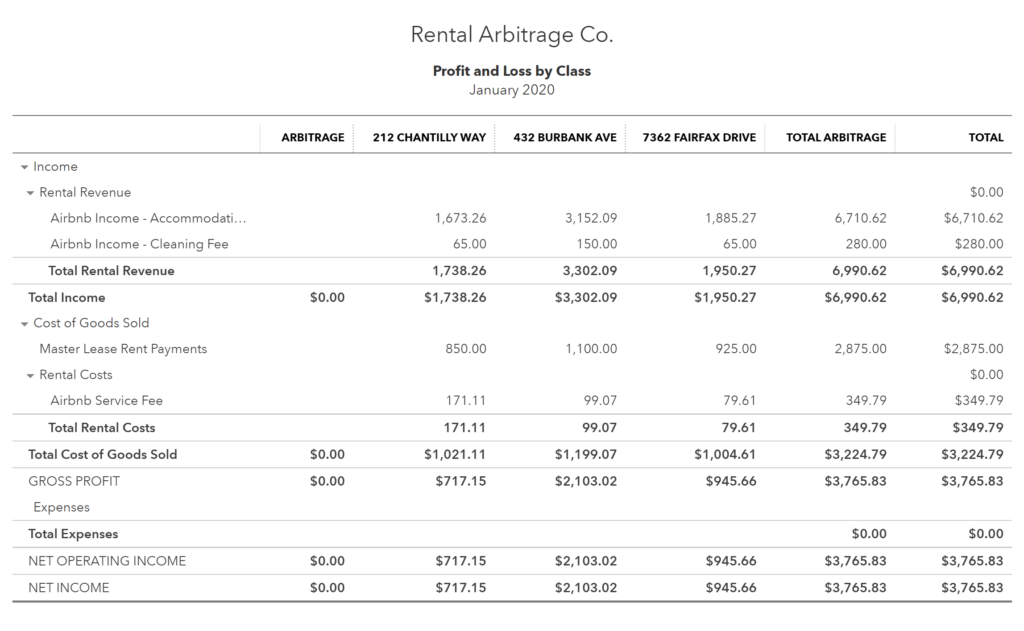

Monthly Reporting for Airbnb Arbitrage

Using Bnbtally, Airbnb reservation data is automatically processed in QuickBooks without a hitch. Once your expenses are recorded in QuickBooks, you can produce beautiful monthly reports with ease and can observe the performance of each listing without any hassle at all.

Profit & Loss by Class

This report is for those who want to compare how their Airbnb Arbitrage listings are performing against each other. It can be found under the QuickBooks left menu label “Reports”. From there, look for “Profit and Loss by Class”. The profitability of each listing for your Airbnb Arbitrage operations can be viewed in this report – the most profitable listings will be clear.

Conclusion

Airbnb arbitrage can be an incredibly lucrative business model that requires modest up-front costs yet allows you to retain control over your accommodation brand. However, keeping a close eye on your numbers is key, especially when it comes to acquiring more properties and negotiating with current and upcoming landlords. It is important to consistently monitor your listing performance and process the correct numbers in order to understand how well your operations are performing – which, in turn, will allow you to make the most profitable decisions.

A streamlined accounting method provides a great deal of transparency into the success of your business – something we hope you have received from this guide as you build your firm. To automate Airbnb Arbitrage accounting, check out the link below!

Finally, there are other business models that are not covered in this guide but are covered better in the following guides. Be sure to check these out :

- Airbnb Co-Host Accounting in QuickBooks

- Airbnb Investment Accounting in QuickBooks

- Trust Accounting for Airbnb Property Managers in QuickBooks

- Airbnb Property Management Alternative Accounting Method in QuickBooks

- All Airbnb templates for QuickBooks

- Airbnb Accounting & Bookkeeping: A Comprehensive Guide

7 thoughts on “Airbnb Arbitrage: An Accounting Guide for QuickBooks”

Comments are closed.